Leeward Investment Team

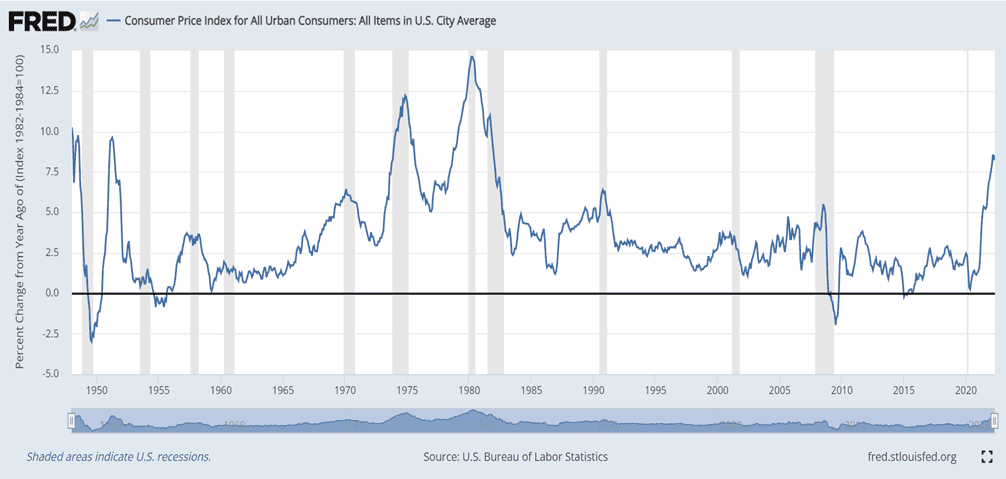

Inflation, as measured by the one-year change in the Consumer Price Index, rose to 8.6% in May 2022, the highest level since 1981.

Source: FRED, as of 5/31/22

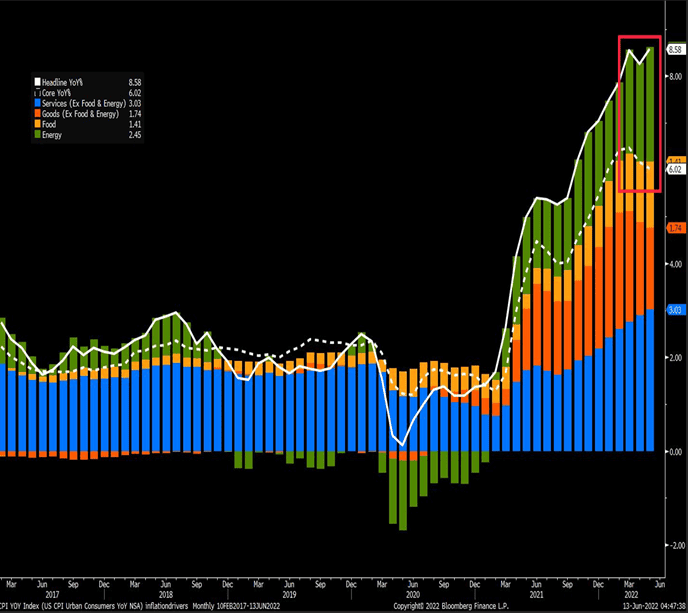

The red box in the chart below shows the significant impact of the War in Ukraine on food and energy prices.

Since energy is a baseline input to many goods and services, the surge in oil and gas prices contributes to measures of core inflation. For example, Airfare prices are directly impacted by energy costs.

Source: Bloomberg, Bureau of Labor Statistics, as of 5/31/22

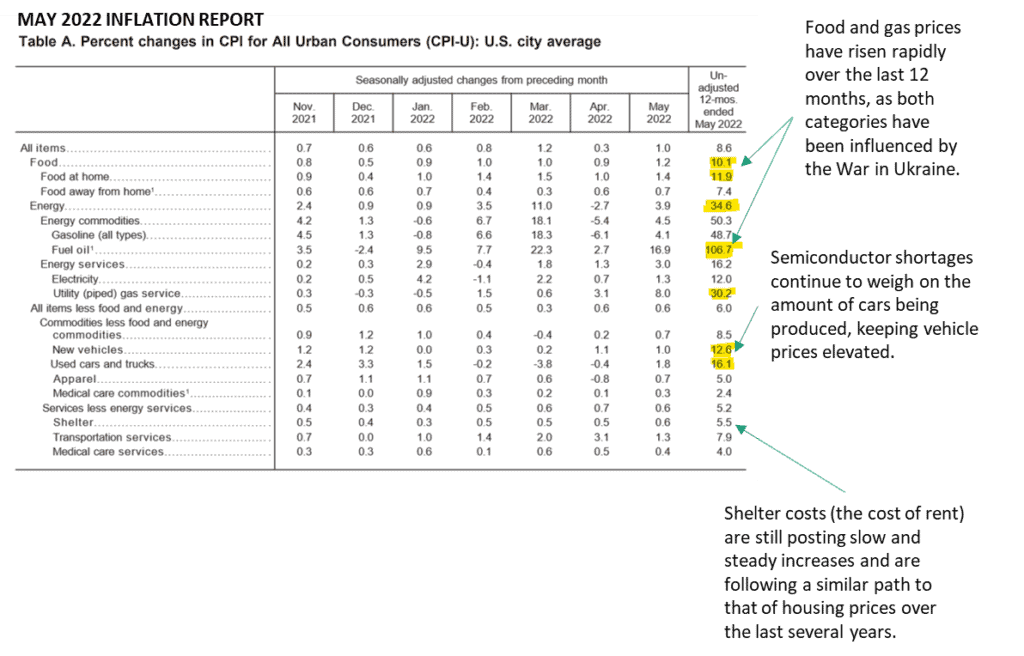

Source: BLS, as of 5/31/22

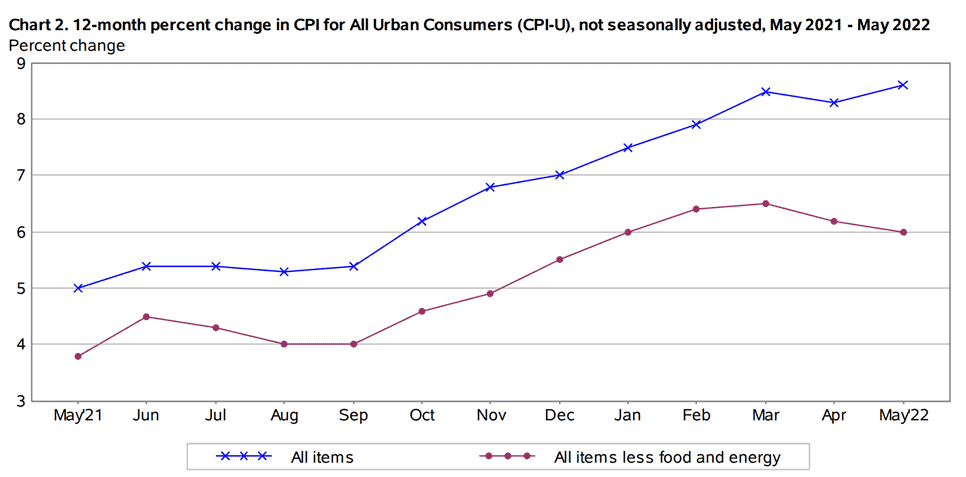

The decline in the purple line in the chart below means that inflation is starting to slow down for things like refrigerators, vehicles, clothes, and other goods. This is good news.

The blue line in the chart below includes food and energy and shows how strongly these categories impact inflation.

The War in Ukraine is having a large impact on the blue line, but not as much of an impact on the purple line. The purple line is more important.

Source: BLS, as of 5/31/22

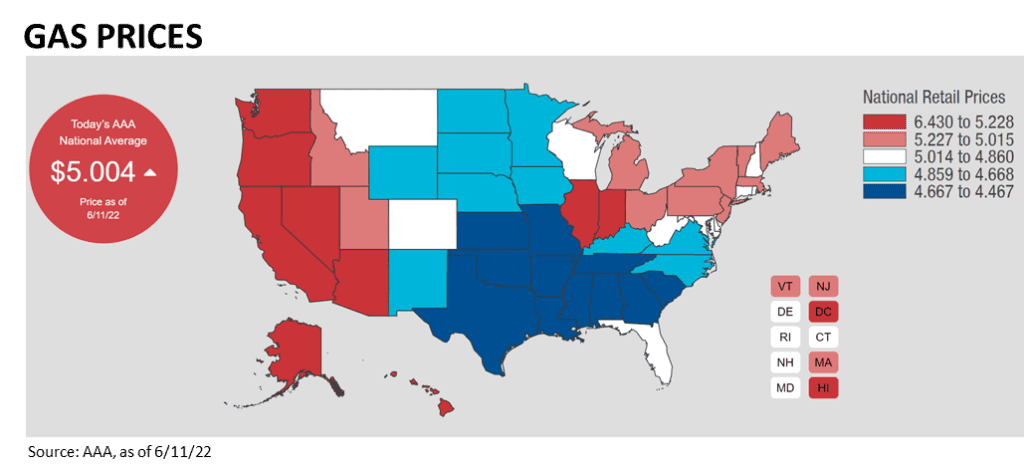

The bad news is that energy are high and rising and these costs hit lower-income people harder.

As we enter the summer driving season, we expect gas prices may reach $7/gallon in many areas.

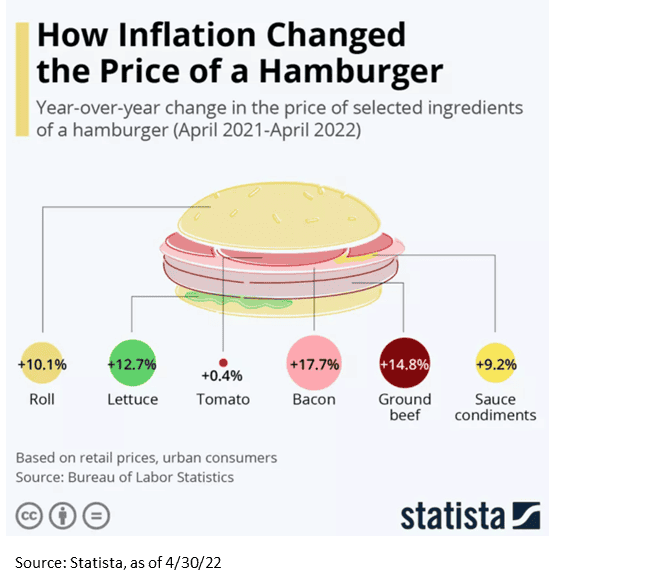

Additionally, food prices have risen over 10% over the last year.

The cost of eating in has risen 11.9%, and the cost of eating out has risen 7.4%.

The only food category that has gotten cheaper is our kids’ lunches (elementary and secondary school lunches -44%), which is a function of tax-payer funded “free lunches” through the pandemic.

Inflation will be lower, sooner, if:

• Any improvement on the Ukraine-Russia front will reduce the risk for further price gains for food and energy products.

• Easing in supply chain disruptions slow down inflation for durable goods like vehicles and furniture

Inflation will be higher, longer, if:

• Rising wages drive companies to raise prices further, prompting workers to demand pay that keeps up with inflation. This is called a wage-price spiral.

• Shelter costs rise faster. The cost of rent is increasing at a moderate rate and may accelerate. Shelter costs have risen 5.5% over the last year and may move higher.

• Become more defensive: This year, we have made multiple adjustments to make portfolios defensive and to shelter those portfolios from the erosive impact of inflation.

• Invest in assets that benefit from inflation: While narrow in scope, there are areas – commodities, energy, materials, and industrials – that do well in inflationary environments.

• Minimize bond exposure: Long-term bonds do not mix well with inflation. Short-term bonds and inflation-protected fixed income are more effective in inflationary environments.

•The market sell-off is creating opportunities. Many quality companies are oversold and look attractive to us.

•For example, higher inflation over the short term doesn’t mean that the value of the entire US technology sector should be 30% lower than where it was in 4Q 2021.

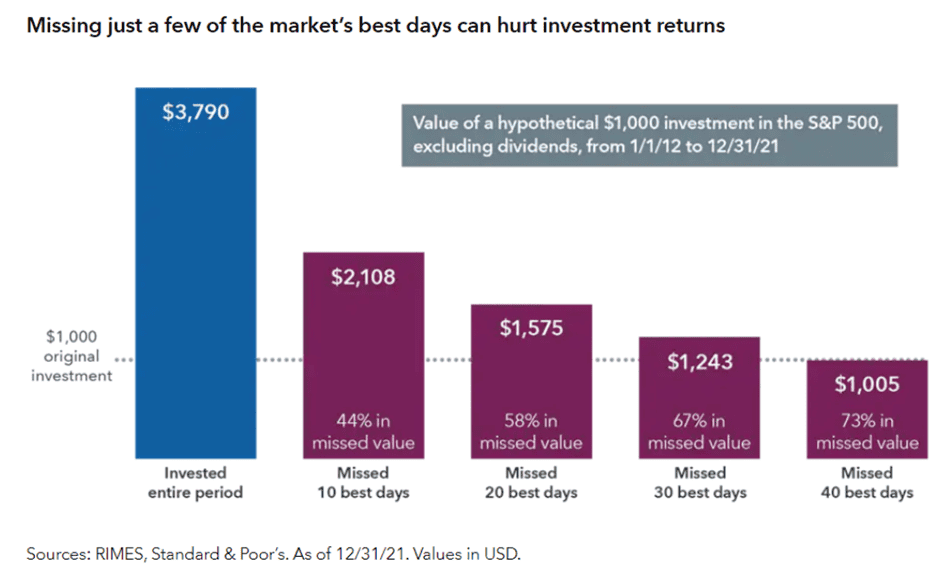

•Timing is key. There is no reason to rush into oversold securities immediately. Making sure investments participate in a market recovery is most important.

We are in a bear market cycle. Portfolio values are in decline, driven by inflation and negative news flow. Periods like this are uncomfortable and challenge conviction.

Fortunately (or unfortunately) we have been here before. Most market cycles are similar even if what creates a sell-off and recovery always seems to be different.

We are in a market bottoming process, but any market recovery will take time to develop. Experience has taught us that patience and consistency are paramount when navigating markets like the one we have today.

We have a good plan which we are working diligently on to execute.

Thank you for your trust and partnership. Please reach out to us with questions and comments. We look forward to hearing from you.

Sincerely,

Jim and Mike

jim@leewardfp.com

mike@leewardfp.com