Leeward Investment Team

Markets surged to close the year, fueled by the Federal Reserve Bank (Fed) signaling the end of the rate hike cycle. After a massive increase in interest rates in 2022, which resulted in the worst year for bonds since the 1980s, the question to start 2023 was, “Have we reached peak interest rates?”. The answer, in hindsight, was “Close, but quite yet.”

In the first half of 2023 interest rates moved sideways, and the technology sector, driven by Artificial Intelligence (AI), hit its best six-month start to a year since 1983. However, in the third quarter, the rise in interest rates resumed, and the 10-year Treasury yield rose above 5.0% for the first time in over fifteen years. Stocks and bonds suffered over this period, with bond investors nearing capitulation territory. Finally, an inflection point was reached at the November 1st Fed meeting, where officials kept interest rates unchanged for the second consecutive month and hinted that they might be finished with the most aggressive tightening cycle in four decades. From that point, bond yields plunged, and it was off to the races for all asset classes.

Leeward’s U.S.-based focus continued to pay dividends in the fourth quarter, as U.S. equities, powered by mega-cap tech companies, outpaced international and emerging equity markets. The S&P 500 Index posted an 11.6% return for the 4th quarter, extending full-year gains to 26.2%. In the fourth quarter, U.S. small-cap equities (+14.2%) outperformed large-cap equities (+11.6%), but lagged large-caps over the full year (+16.8% vs. 26.2%). The tech-heavy NASDAQ notched a +14.6% return in Q4, pushing the 2023 return to an astonishing +45.7%. Building momentum for artificial intelligence added wind to the sails of expected winners, including chipmakers Nvidia (+239%) and Advanced Micro Devices (+128%). From a sector perspective, the Communication Services (+44.8%), Information Technology (+52.7%), and Consumer Discretionary (+40.4%) sectors led the way.

Outside of the United States, equity performance was modest. The MSCI EAFE Index, which tracks the equity markets of developed Europe and Asia, advanced +10.9% in the fourth quarter and +18.0% for the full year. The emerging markets fared worse, as the MSCI Emerging Markets Index registered an +8.4% return in Q4 and a full-year return of +11.5%. Still respectable returns, but lagging U.S. markets. Looking under the hood, weakness in China proved the major fly in the ointment in Asia as the country dealt with deteriorating demographics and a seemingly perpetually problematic and overleveraged housing sector. As of mid-January, China’s stock market was notching new 3-year lows.

For fixed-income assets, the U.S. bond market rallied off generational lows in November and December, booking returns of +4.6% and +3.7% respectively, pulling the overall bond market back into positive territory for 2023 (+5.7%). We now have conviction that we are done seeing negative annual returns in the bond market, which has been a detractor from portfolio performance over the last three years. Bonds perform well in interest rate-cutting environments, which we believe we are entering. Commodities performed poorly in 2023 (Bloomberg Commodity Index -7.9%) as the inflation picture improved marginally. The Energy Sub-Index declined 21.6% over the year, driven by falling oil prices, which could fall further if Saudi Arabia follows through with its threat to flood the markets to pressure other OPEC nations into complying with production quotas. Looking out across the rest of the commodity space, only precious metals (+9.6%) and soft commodities such as sugar, coffee, and cotton (+18.5%) posted decent returns. The former category bounced back after several years of poor performance driven by interest rate increases, and the latter category benefitted from a series of poor sugar harvests in India and China. Finally, REITs managed to climb back into positive territory for the year (+11.2%) entirely due to an interest-rate-induced rally in November (+11.6%) and December (+9.1%).

Last year, economic prognosticators would emerge from their dens each quarter, see their shadows, and predict a recession. Not now, and not in the next few weeks or months, but generally some arbitrary time six to nine months in the future, or our personal favorite… “sometime next year.” However, by the end of the fourth quarter, many groundhogs no longer saw their shadow and were willing to announce an early spring and “soft landing” for the U.S. economy.

In honor of the change in the forecast, we are including our favorite image. On the next page is a picture showing market “bears” landing on a bed of pillows. The economy is not going into recession but is going to have a “soft landing.”

Source: JPM Asset Management

What changed? Why was the consensus wrong? Simply put, the U.S. economy is remarkably resilient. Driven by higher productivity through Artificial Intelligence (AI), a tight labor market, and strong consumer confidence, the U.S. economy grew throughout 2023. Real GDP growth was 5.2% in the third quarter last year and should grow 2.4% in the fourth quarter (4Q GDP growth has not been reported officially). For all of 2023, GDP growth will be about 3%, far ahead of expectations from the beginning of the year. We expect growth to remain positive into 2024, even as the economy cools. Full-year GDP will be lower than last year, but we don’t anticipate an economic collapse over the next twelve months.

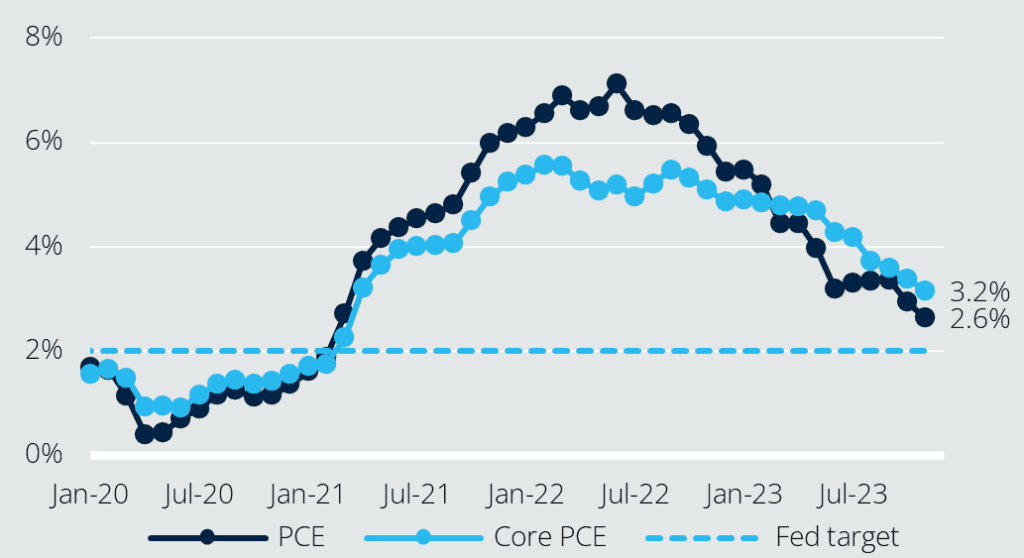

Inflation is declining. Price growth ended the year at 3.4%, a significant improvement from the high-water mark of 8.2% in September 2022 but still above the Fed’s target of 2.0%. The chart below illustrates how much inflation has fallen since its 2022 peak.

Source: Bureau of Economic Analysis

Food, energy, goods, and services are the primary components that comprise inflation calculations. Food and energy are volatile and not good indicators of long-term inflation direction. Oil prices, for example, exhibited some blips throughout 2023 but ended the year at a slightly lower price tag than where they had begun. Goods and service prices are more stable and larger components of the economy. For this reason, we focus on goods (new vehicles, apparel, finished products) and services (rent, transportation, medical care) to forecast inflationary trends. Goods inflation has returned to historical levels, but price increases remain elevated on the services side of the economy. Shelter costs and transportation services continue to rise, leading us to believe that inflation while falling, will remain elevated in 2024.

The labor market has begun to cool, albeit only slightly. The unemployment rate finished the year at 3.7%, with 216,000 jobs added in December, just below the monthly average mark for the year (225,000). Annual wage growth ticked up to 4.1% in December, slightly ahead of inflation rates. Labor force participation didn’t move much for the year, but the number of people seeking employment increased by about half a million. We do not believe unemployment will increase materially next year. There is a mismatch in the U.S. economy between the skills available and the skills required in the labor force. As the economy slows throughout 2024, we expect wage growth to stall and new jobs additions to slow. This should cause the labor market to soften marginally, but nothing to indicate a spike in unemployment.

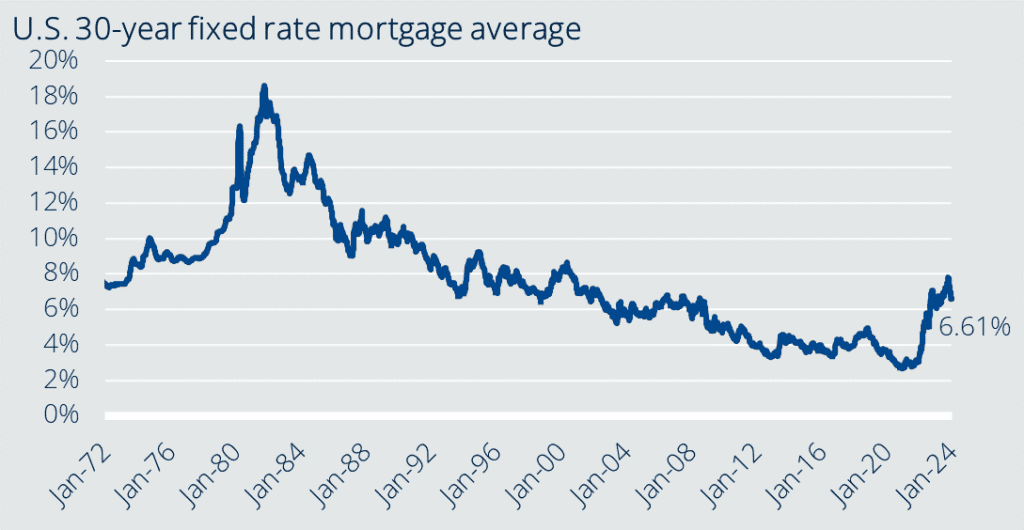

Conventional mortgage rates peaked late last year at 7.8% and have since fallen to 6.6% by mid-January. These levels are almost three times the 2.7% rates we saw in late 2020. The rapid rise of mortgage rates has had a rippling effect on the housing market. Builder sentiment has weakened, and the median time houses have remained on the market has ticked higher. These trends can be attributed to the rapid paceof interest rate increases over the last year, which have increased the cost of development (reducing supply) and increased cost of ownership (lowering demand).

Despite slowing demand, we do not foresee a collapse in housing prices. The U.S. housing market has been underbuilt for over a decade, and current estimates have the U.S. undersupplied by about 2.3 million homes. Structural supply issues remain, and higher construction costs will flow through to higher home prices. We believe there is room for mortgage rates to fall, which would help with affordability, but lower mortgage rates will not push home prices lower. Below is a historical chart of 30-year fixed-rate mortgages. Rates will drift below 5% over the next 18 months, but we don’t anticipate a return to 2020 levels.

Source: Freddie Mac, Federal Reserve Bank of St. Louis, FRED

The Fed’s mandate is maximizing employment, stabilizing prices, and moderating long-term interest rates. Currently, we are in a restrictive monetary policy environment designed to stabilize prices (i.e., reduce inflation). As long as unemployment remains low, GDP growth stays elevated, and shelter costs remain high, we anticipate remaining in the current restrictive environment.

Last November, the Fed signaled that they were done raising rates. As we move into 2024, Wall Street strategists estimate up to six rate cuts throughout 2024. This forecast is aggressive.

The most recent minutes from the December Fed meeting indicated that officials viewed a lower benchmark rate as “appropriate by the end of 2024”, given “clear progress” toward taming inflation. Unfortunately, we doubt there will be “clear progress” by the end of 2024. The last stages of inflation reduction are the most difficult. Still, looking back through history, rates tend to get cut a lot all at once, not sequentially over time, and we believe that unless there is a downward shock to the economy, necessitating a policy response from the Federal Reserve, the Fed is more likely to undercut (leave rates higher for longer) than overcut. We anticipate rate cuts will be minimal in 2024 because the U.S. economy will be stronger than expected and will necessitate interest rates remain higher for longer.

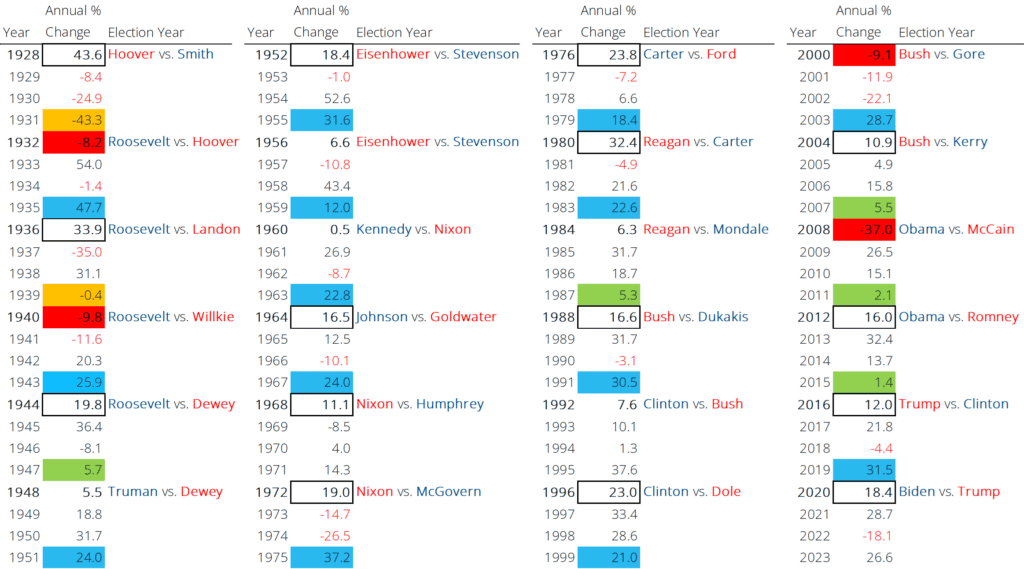

One reason to be optimistic about performance in 2024 is that markets tend to move up during election years. Politicians put major reforms on ice, resulting in less-surprising, market-friendly gridlock. In the 24 general election years ranging back to 1928, the U.S. stock market delivered an average return of 11.6% and only recorded negative performance in four years. Those four negative years were 1932 (Great Depression), 1940 (World War II), 2000 (Dotcom Bubble), and 2008 (Global Financial Crisis). So, if history is a guide, stocks have gone up every general election year when there wasn’t a major financial crisis or global war involving the United States. The trend is bipartisan, irrespective of which party wins the White House.

Below is a table showing the annual details. Even with a strong year before the election year (like in 2023), election years tend to produce positive returns.

Out of the 24 general election years since 1928, only four have produced negative returns - 1932, 1940, 2000, and 2008. These years are colored in red. Only two of the election years saw negative returns in the prior year - 1932, 1940. These years are colored in orange.15 of the years prior to election years had double-digit returns (blue) and five had single-digit returns (green). Additionally, 15 of the 24 general election years featured double-digit positive percentage returns for the overall market. If history is a guide, the odds are that 2024 should be a positive year for the stock market.

In 2024, we expect positive returns in equities and fixed income. The macroeconomic backdrop is lining up closer to a soft landing than a recession. Investors will initially digest 2023’s strong returns before pivoting to forecasts for earnings growth in 2024. We are optimistic. We believe companies will benefit from a soft landing. Stocks prices will grow but will not rise as sharply as last year. Bonds have a chance to produce substantial risk-adjusted returns in 2024 but will be dependent on changes to rate cut expectations (which are overly aggressive). Downside risk could come if inflation increases, consumer demand weakens, or national debt levels come into focus. Also, there could always be a new geopolitical surprise to the downside. On the positive side, if we see a broadening in leadership to non-mega-cap names, and if the economy remains robust, we expect to see one of the strongest IPO cycles we’ve seen in a while. The IPO candidate list is robust.

We often advise folks not to get too excited in January. This year is no different. The start of the year will be bumpy but should settle out as new economic data is reported and trends emerge. We will monitor developments during corporate earnings season and the January Fed meeting to gain conviction on the economy's direction. We like our current positioning and expect to participate in market upside if earnings develop as expected.

We appreciate your confidence and partnership.

Sincerely,

Jim and Mike

jim@leewardfp.com

mike@leewardfp.com