Leeward Investment Team

Last quarter, we noted that April showers had brought May flowers—and a few months later, those early gains have blossomed into six months of strong performance across both equity and bond markets. By the end of the third quarter, the S&P 500 had advanced nearly 14.7% year-to-date, while the broad bond market returned 6.2%, its best showing since 2020. Although risks remain, the overall outlook feels less uncertain than it did earlier in the year, providing fertile ground for continued market strength.

Global equity markets continued their upward trajectory in the third quarter, supported by strong earnings, moderating inflation, growing optimism about rate cuts, and renewed monetary stimulus.

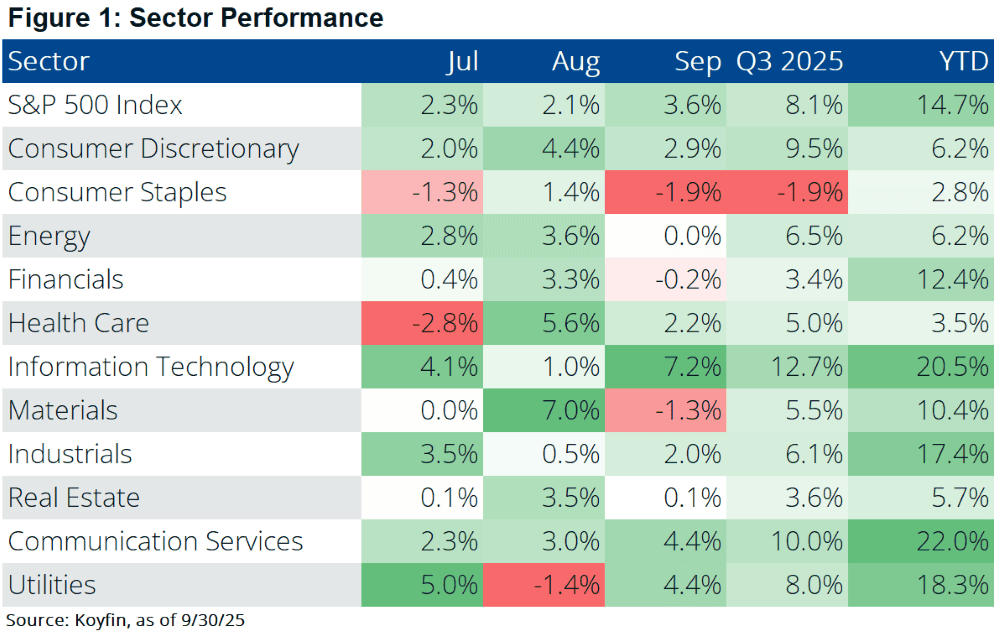

The S&P 500 advanced each month, delivering an 8.1% total return for the quarter and lifting year-to-date gains to nearly 15%, well above the 6-8% range we had anticipated for the full year. Pro-cyclical sectors once again led the way, with Technology (+12.7%), Communication Services (+10.0%), and Consumer Discretionary (+9.5%) sectors outperforming. In contrast, Consumer Staples (-1.9%) was the lone sector in negative territory, weighed down by names such as Costco, Procter & Gamble, and Coca-Cola.

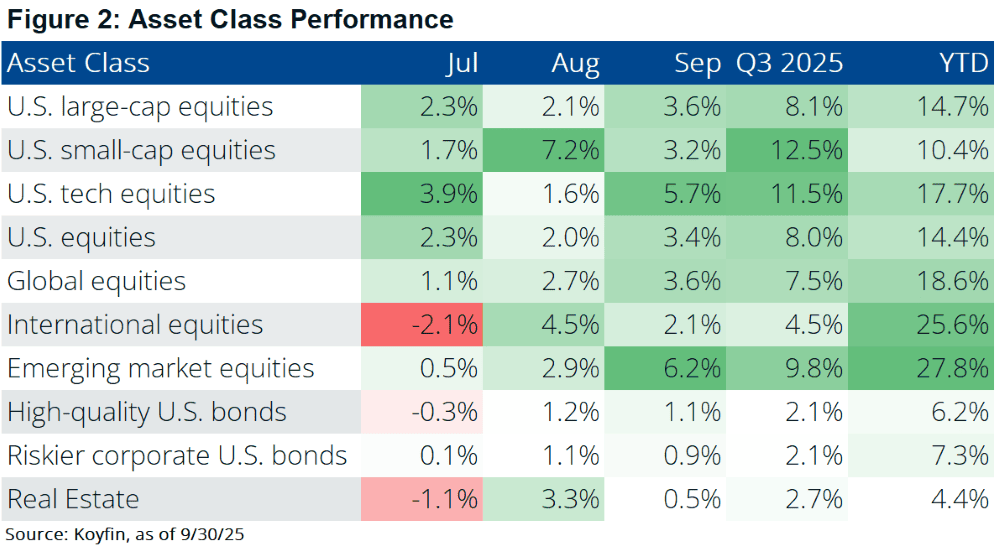

Small-caps benefited from the positive sentiment, gaining 12.5% for the quarter, though they still trail large-caps by roughly 4% year-to-date. International and emerging-market equities also advanced, maintaining a modest lead over U.S. markets, although this outperformance is primarily a result of dollar weakness. Within emerging markets, Chinese equities (+18% in Q3) stood out, buoyed by a wave of stimulus from the People’s Bank of China.

Bond markets rallied as yields declined across the curve. The 10- and 30-year Treasury yields each fell modestly, about 0.10%, while the 1-year yield dropped from 3.97% to 3.63%, reflecting higher expectations for intermediate-term rate cuts. Investment-grade bonds have now returned 6.2% year-to-date. Credit spreads remain tight, suggesting limited upside in riskier corporate bonds and low default risk.

In commodities, gold surged to new highs just below $3,900/oz amid concerns over U.S. fiscal sustainability and a weakening dollar, while crude oil traded in the $60–$70 range, generally supportive of global growth.

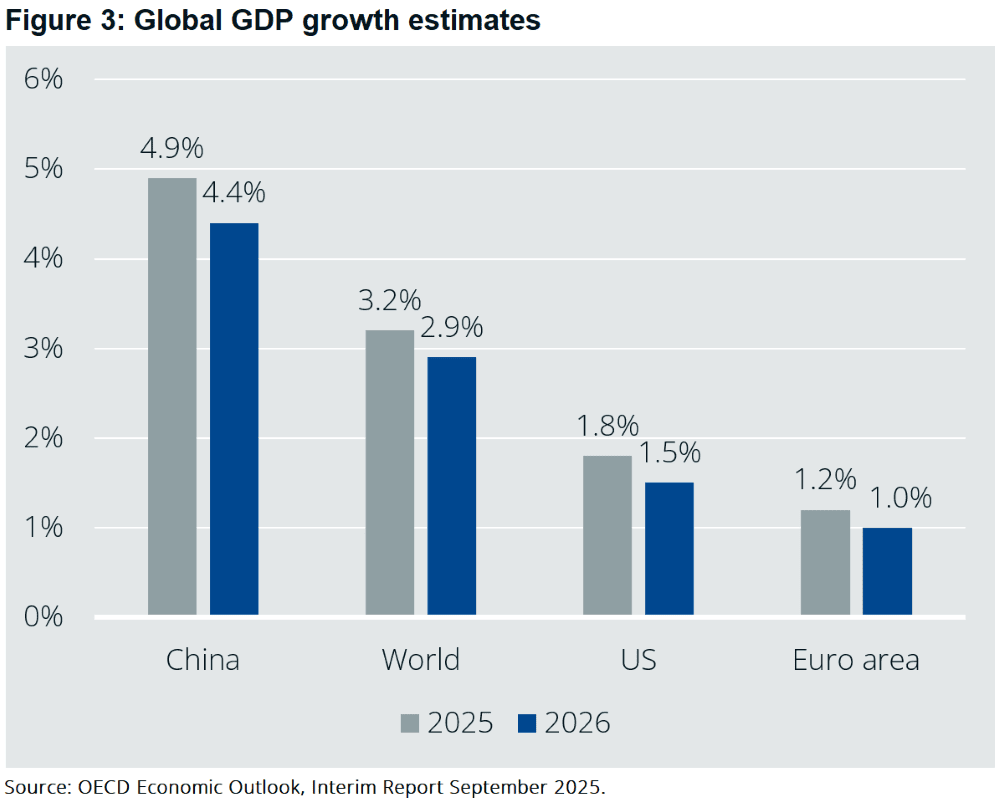

The U.S. economy remains resilient, expanding at a 3.8% annualized pace in the second quarter. Net exports contributed 4.8 percentage points to growth, largely offsetting the drag in the first quarter when companies rushed to import goods ahead of tariff imposition. Meanwhile, a drawdown in private inventories subtracted 3.4 percentage points, reversing the “restocking” boost seen in Q1. As these components normalize, we expect growth to moderate somewhat. Encouragingly, the core drivers of the economy - consumer spending and business investment - collectively grew 2.7% in the second quarter, up from 1.7% in the first, boosted by corporate investment in AI technologies. In Figure 3 below, you can see that U.S. GDP growth expectations sit just below 2% in 2025, and that growth is expected to moderate to 1.5% in 2026.

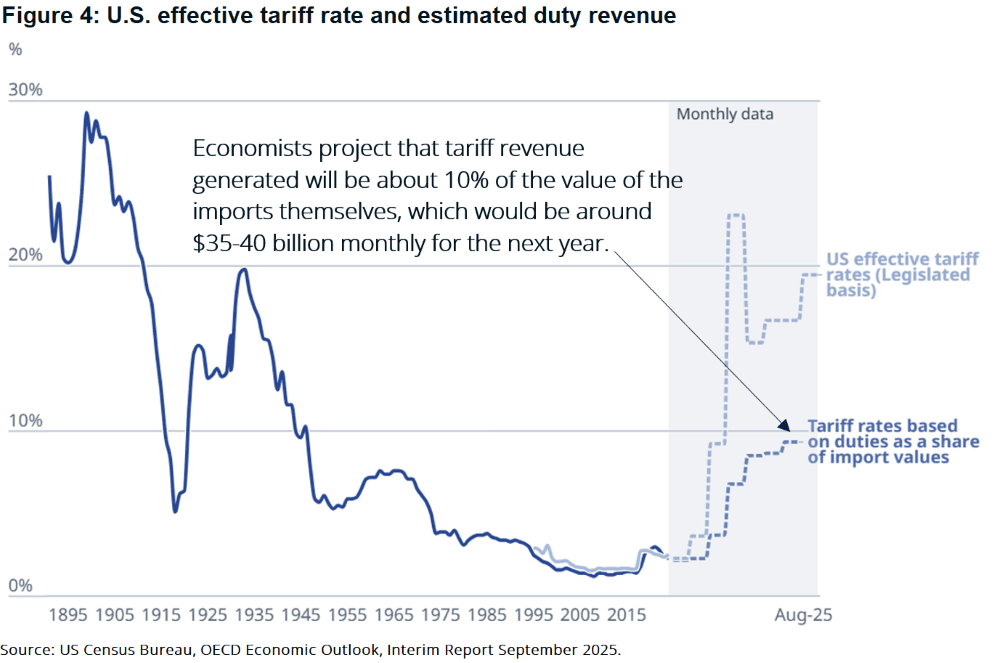

Inflation edged higher from 2.7% to 2.9% in August - still above the Fed’s comfort zone but well below the levels feared when tariff negotiations began earlier this year. The muted impact likely reflects a combination of factors, including delays associated with ongoing negotiations, softer demand, and the uneven pace at which price increases are passed through supply chains. Figure 4 below depicts the projected effective tariff rate today, and how it compares historically.

We don’t view inflation risks as alarming at present. Energy prices are relatively stable, helping to contain headline inflation; however, goods prices are starting to firm up again, and services inflation remains stubbornly high. We’ll continue to monitor these dynamics, but in recent weeks, the Fed’s tone has shifted away from inflation and toward weakening in the labor market.

The labor market has softened in recent months, as reflected in slower payroll growth, declining labor force participation, and a pullback in the number of foreign-born workers. Other indicators tell a similar story: job openings have declined, the quit rate has decreased, and layoffs have increased.

That said, while most measures are moving in the wrong direction, many are simply reverting to their pre-pandemic norms after several years of extraordinary strength. In that context, the Fed’s shift in focus from inflation to labor conditions seems appropriate, but the data does not yet suggest an economy in need of support. As a result, the path ahead is likely to include fewer rate cuts than markets may hope for, especially with inflation risks still lingering.

Elsewhere in the economy, manufacturing activity continues to contract as new orders decline under the weight of tariff-related uncertainty. In the Institute for Supply Management’s latest surveys, several firms cited tariffs as a key factor restraining business activity. One company in the Computer & Electronic Products industry noted that “tariffs continue to wreak havoc on planning and scheduling activities.”

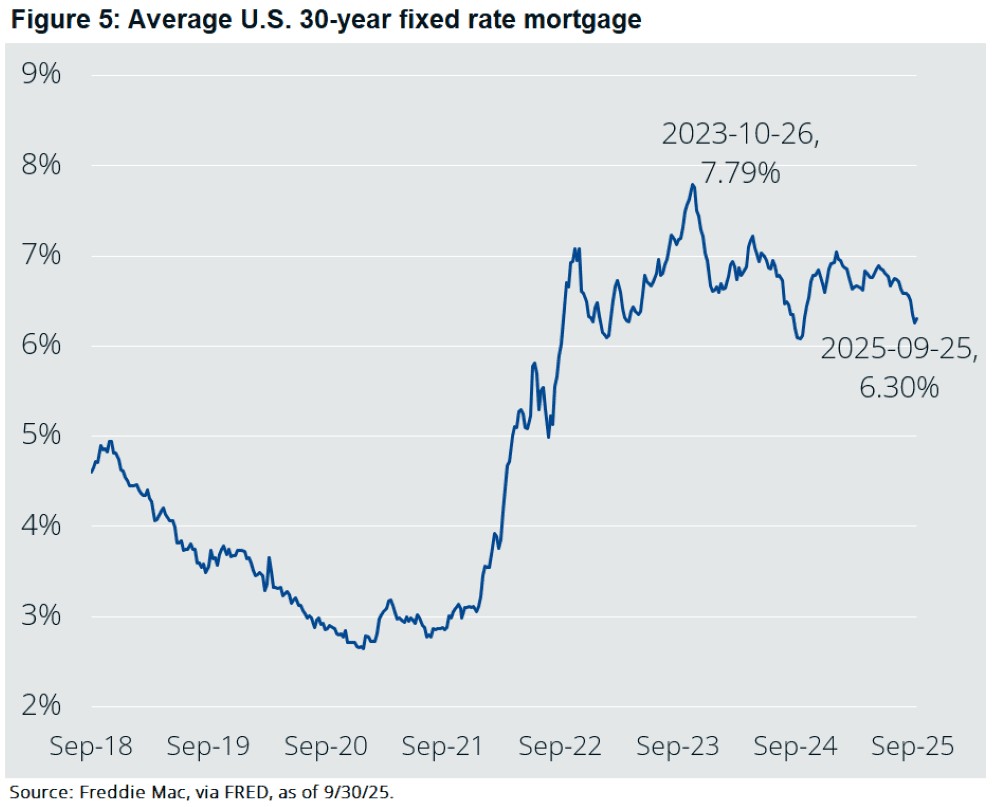

In contrast, the housing market showed surprising strength in August, with new home sales surging 21% to an annualized pace of 800,000 units. The rebound was fueled by expectations for further mortgage rate declines, along with aggressive discounting and promotional incentives from homebuilders. While revisions in future months may temper the sharp gain, history suggests such bursts in sales often coincide with periods of falling mortgage rates. The average 30-year fixed rate ended the quarter near 6.3% - roughly 1.5% below recent peaks from this time two years ago.

Over the past decade, the Federal Reserve has moved from being a quiet force operating in the background to one of the most visible and debated institutions in the country. Much like the Supreme Court, it’s now at the center of heated discussions about independence and accountability.

Many market participants have argued that pressure from the Trump administration risks undermining the Fed’s independence and could blur the line between politics and monetary policy. Others, including Treasury Secretary Bessent, have warned that the Fed’s influence has expanded beyond its original mission and that its policies have sometimes exacerbated inequality and distorted certain parts of the economy. In a white paper released earlier this year, Bessent stated that while economic models do not have political biases, “they are based on certain beliefs about how the economy works, which may in turn be correlated with various political views.”

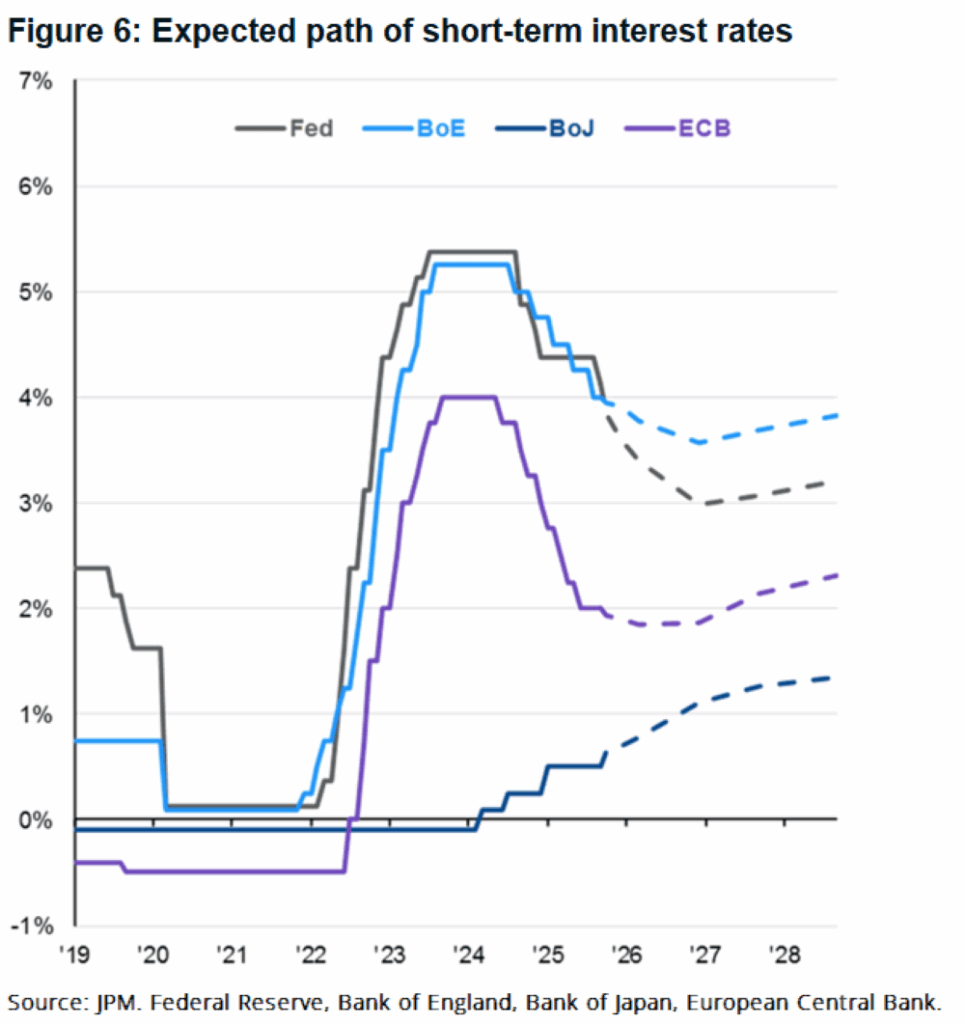

Our role isn’t to take sides in that debate, but to focus on what’s most likely to happen and what it means for investors. Currently, short-term interest rates range from 4.00% to 4.25%. We expect the Fed to lower rates twice more before year-end, likely in October and December, bringing the federal funds rate down to around 3.50–3.75%.

The 2026 outlook is less clear. The Fed’s latest official projections (from the June Summary of Economic Projections) call for a year-end rate of 3.6%, suggesting no additional cuts after the two expected later this year. Markets, however, are pricing in two more reductions, which would bring the federal funds rate closer to 3% by the end of next year. Figure 6 below shows the path of short-term interest rates in the United States (Fed), the United Kingdom (BoE), Japan (BoJ), and the Eurozone (ECB), as well as the market’s current expectation for their paths moving forward.

Fed Chairman Powell has recently cautioned about “highly valued” stock markets and the “challenging situation” the Fed faces in balancing growth with persistent inflation risks. As we’ve noted in past commentaries, given those risks, we believe the Fed is likely to ease policy more cautiously than markets currently anticipate.

On August 29, 2025, the U.S. Court of Appeals for the Federal Circuit ruled 7–4 that most of President Trump’s “reciprocal” and “trafficking” tariffs exceeded his authority under the International Emergency Economic Powers Act (IEEPA). The decision was stayed until October 14 to allow an appeal, and most legal observers expect the Supreme Court to ultimately uphold the ruling against the administration. Still, the U.S. Trade Representative has suggested the White House could rely on other statutes to preserve tariffs as a trade policy tool. If the Supreme Court reverses course—or if the administration succeeds in maintaining tariffs through alternative means—it could add upward pressure to inflation, increase uncertainty around Fed policy, and weigh on risk assets, such as U.S. equities.

Earnings revisions pose a key risk to the equity market outlook. The S&P 500 is now expected to post 8.0% year-over-year earnings growth in Q3, up from 7.3% at the end of June - reflecting a wave of positive revisions that have supported higher prices. If that optimism fades and estimates begin to roll over, valuations would quickly look stretched, likely dampening sentiment and prompting some price compression. Figure 7 below shows the expected quarterly earnings of the S&P 500 companies over the next year and change.

We are still in the early stages of the artificial intelligence era, and it will take time to fully understand how these technologies will reshape business operations and the labor market. As noted in our last quarterly report, recent college graduates are facing a more challenging job market than other cohorts - likely because the entry-level roles they typically fill are among the most susceptible to automation. While this dynamic may boost corporate efficiency and profitability in the near term, it also risks eroding the long-term health of the labor force.

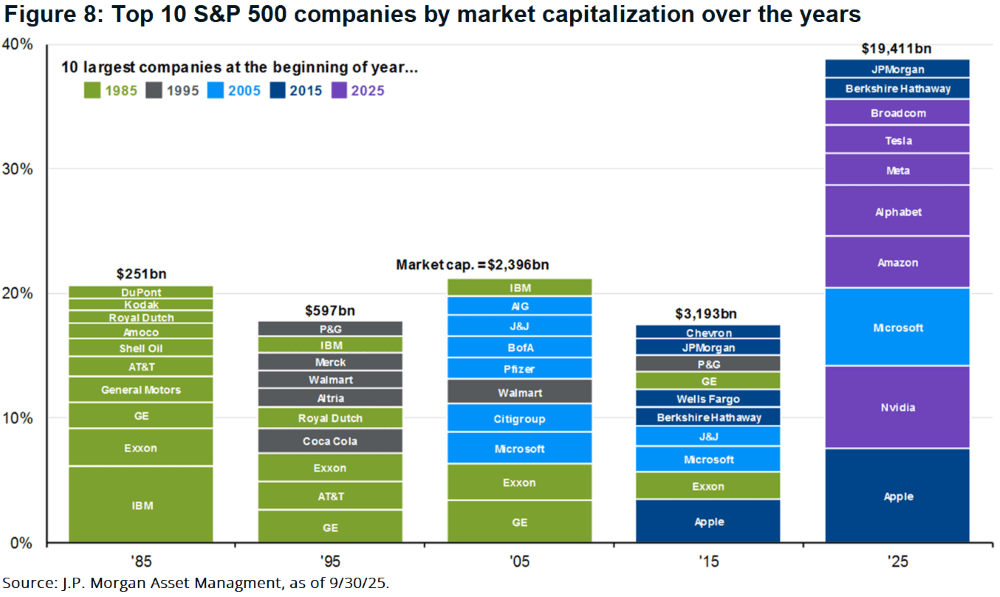

Market concentration is another dynamic we’re keeping our eye on. Figure 8 below shows the market capitalization and weight of the 10 largest companies in the S&P 500 Index for 1985, 1995, 2005, 2015, and 2025. While the weight of the top 10 companies has averaged around 18-20% historically, the top 10 companies today account for nearly 40% of the overall S&P 500 Index.

We’re pleased with how portfolios are positioned, which is why trading activity in the third quarter was lighter than during the tariff-driven volatility of Q2. We remain confident that a modestly declining rate environment, a resilient economy, and AI tailwinds create conditions for earnings to exceed expectations - supporting a fully invested equity stance. Within equities, we continue to emphasize the tech, consumer discretionary, and communication services sectors, which are most aligned with current innovation trends. As we enter Q4, we are preparing to broaden our exposure to areas we’ve underweighted for much of the year.

We enter the fourth quarter with a greater sense of optimism than we might have expected earlier in the year. The labor market is cooling but remains healthy, inflation is moderate though not without upside risk, and the earnings and interest rate backdrops both appear supportive.

Historically, the fourth quarter has been a favorable period for equities. Since 1990, when markets have entered Q4 with positive year-to-date returns, the average gain for the quarter has been 6.1%. Even in years that began Q4 in the red, average returns have still been positive at +2.2%.

Against that backdrop, a modest increase by year-end would not be surprising. Any short-term volatility would likely represent a healthy recalibration, offering opportunities to add exposure. If current trends hold, we’d also expect improving sentiment to extend into capital markets, with a pickup in IPO activity reflecting renewed confidence in the economic outlook.

As always, we welcome your questions, whether about the economy, markets, or your individual portfolio and financial plan. We sincerely appreciate your continued confidence and partnership.

Sincerely,

Leeward Financial Partners