Leeward Investment Team

Despite unprecedented uncertainty in the first quarter of 2025, markets rebounded sharply and notched another above-trend year, led by the technology, communication services, and industrials sectors. Enthusiasm around artificial intelligence drove much of the sector leadership, as investors sought exposure to its transformative impact across industries. The economy delivered robust growth, while inflation that had loomed for much of the year failed to materialize in the manner many had feared. While we remain optimistic that 2026 will build on the strong economic fundamentals of 2025, the year ahead presents a shifting complexion of opportunities and challenges that will meaningfully shape portfolio positioning and investment decisions.

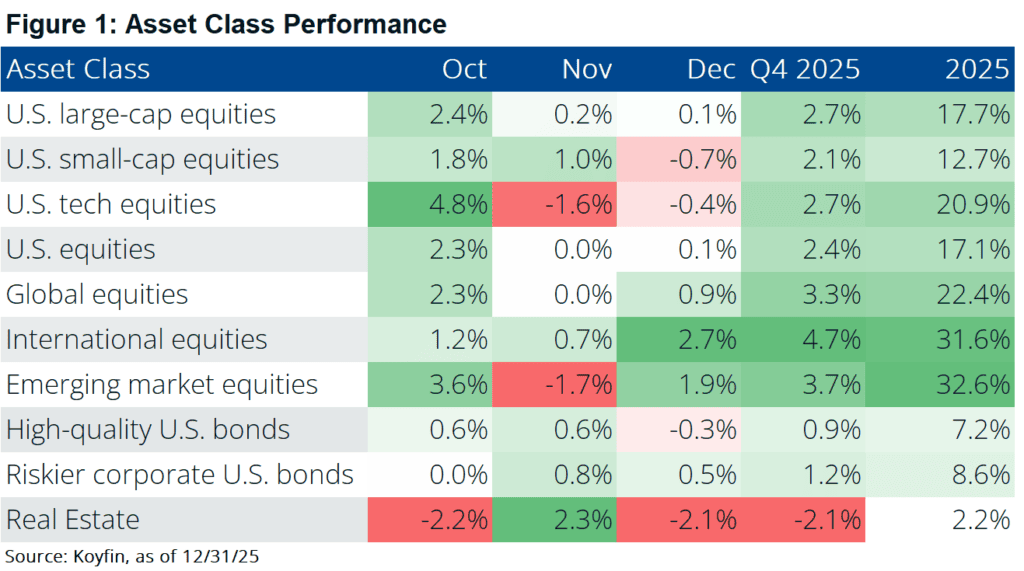

Markets delivered another strong year of returns in 2025, with U.S. equities (S&P 500 Index +17.7%) again exceeding consensus expectations for mid-single-digit gains. Bonds also performed well, with the Bloomberg Aggregate Index returning +7.2% as declining interest rates and high starting yields supported fixed income returns.

Within U.S. equities, performance was highly concentrated. Large-cap stocks outpaced smaller companies, as tariff-related uncertainty weighed more heavily on small businesses, and investor enthusiasm around artificial intelligence remained focused on the largest technology platforms. As a result, the Russell 2000 Index returned +12.7%, underperforming large-cap peers.

International equities had a standout year in U.S. dollar terms, with the MSCI EAFE Index rising 31.6%. Much of this outperformance, however, reflected currency translation effects from a weaker U.S. dollar rather than superior local market performance. In local currency terms, developed international equities returned a still-solid 21.2%.

Emerging market equities also posted strong gains, rising 34.4% in U.S. dollar terms. This is the first time emerging markets have been competitive since 2020. Returns were driven by a narrow set of large markets and companies tied to global AI investment and semiconductor demand, with currencies providing a modest additional boost.

Fixed income performed well across most segments, supported by a constructive economic backdrop and limited credit stress. High-yield bonds modestly outperformed the broader bond market as credit spreads remained near cycle lows, while mortgage-backed securities and emerging market debt benefited from declining inflation and improved fundamentals.

Commodities delivered strong returns over the year, led by gains in precious and industrial metals. Heightened geopolitical uncertainty drove demand for traditional safe havens, while tight supply conditions and continued demand from energy transition projects and AI-related infrastructure supported industrial metals.

The U.S. economy proved far more resilient in 2025 than many had expected. In the third quarter, GDP grew at a 4.3% annualized pace, well above the 25-year average of 2.3%, driven primarily by consumer spending and supported by a weaker dollar that boosted exports.

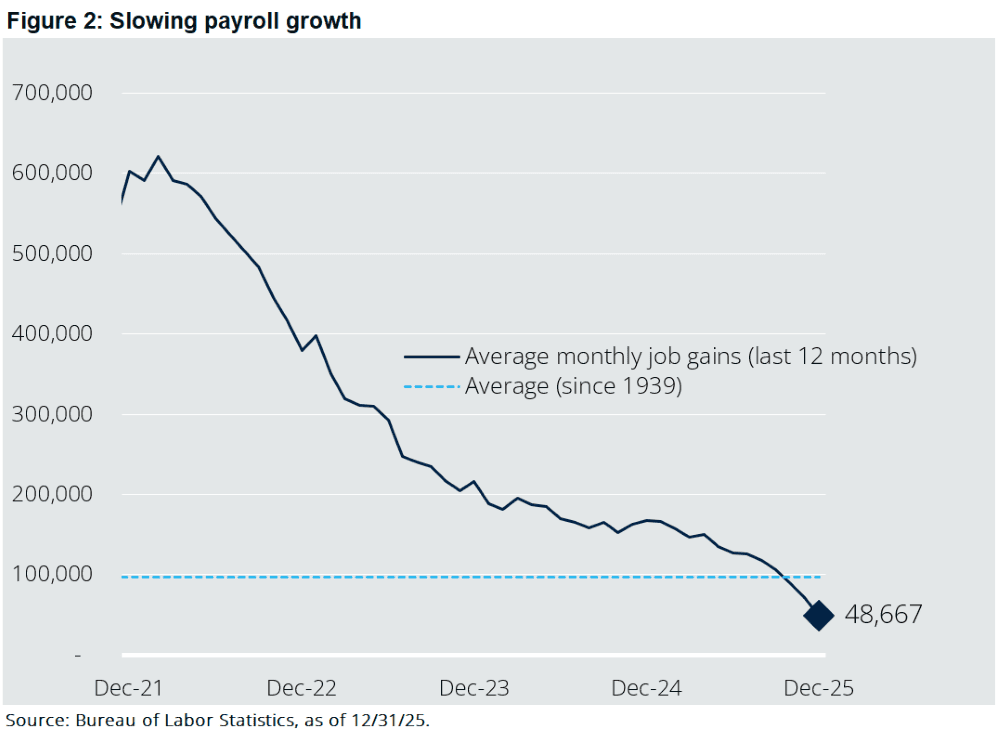

While growth remained strong, the labor market continued to cool. Unemployment ended the year at 4.4%, still a healthy level, even as monthly job gains slowed to roughly 50,000 - well below long-term averages (see Figure 2 below). Looking ahead, payroll growth may remain modest as productivity improves and labor force growth stays constrained. As a result, the unemployment rate may remain in the mid-4% range despite slower hiring, making it a less informative signal of underlying labor market momentum in 2026.

Perhaps the year’s biggest surprise was that inflation failed to reaccelerate despite the rollout of broad tariffs. Headline CPI remained between 2.3% and 3.0% throughout the year, while core inflation cooled to 2.6% by November, driven largely by easing shelter costs. With effective tariff rates more likely to decline than rise in 2026, we do not expect inflation to meaningfully reaccelerate, giving the Federal Reserve greater flexibility to ease policy if economic activity continues to slow.

Despite solid economic growth and moderating inflation, consumer sentiment remains weak. This disconnect reflects the growing divergence between aggregate economic data and the lived experience of the average household. Overall consumption measures total dollars spent, while sentiment surveys reflect individual perceptions, allowing strong spending and pessimism to coexist.

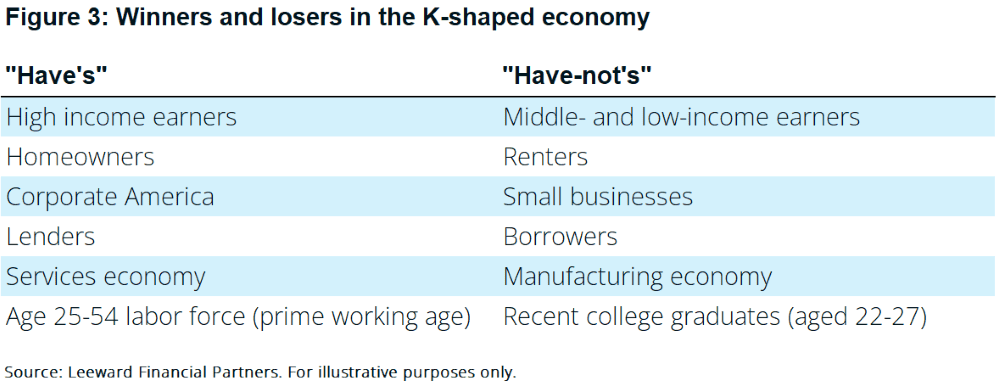

This dynamic has produced what is often described as a “K-shaped economy.” Higher-income households and asset owners benefit from equity market gains, AI-driven wealth creation, and resilient housing prices, while lower- and middle-income households - particularly renters and those without meaningful market exposure - continue to face lower wages and high borrowing costs. We have provided some examples of the “have’s” and “have-not’s” in Figure 3 below.

While this divergence is real, the consumer sector remains supported by strong household balance sheets and ongoing fiscal support. Aggregate household net worth remains near record levels, driven largely by sustained equity market gains. On the liability side, consumer credit conditions have stabilized, though pockets of stress persist in areas such as subprime auto lending.

Taken together, these dynamics help explain why consumer spending has remained resilient despite weak sentiment. Looking ahead, household income growth is expected to remain positive in 2026, supported by fiscal policy and a diminishing inflation headwind, providing a continued - though uneven - backdrop for consumption. If household income growth materially undershoots expectations, particularly in the first half of the year, we would view that as an early warning signal and closely watch for spillover stress across the broader economy.

Our outlook for 2026 includes both opportunities that could support markets and risks that deserve monitoring.

In terms of tailwinds, as we mentioned above, U.S. households could see roughly $100 billion in additional tax refunds in the first half of the year, which will likely be used to consume goods and services or invest in the market. On the corporate side, we could see a change in tax law restoring immediate expensing or accelerated depreciation schedules, which would improve corporations’ after-tax cash flows, encourage business investment, and support earnings growth. Finally, if corporate earnings exceed our expectations, valuations will come down and perhaps entice another wave of investor buying.

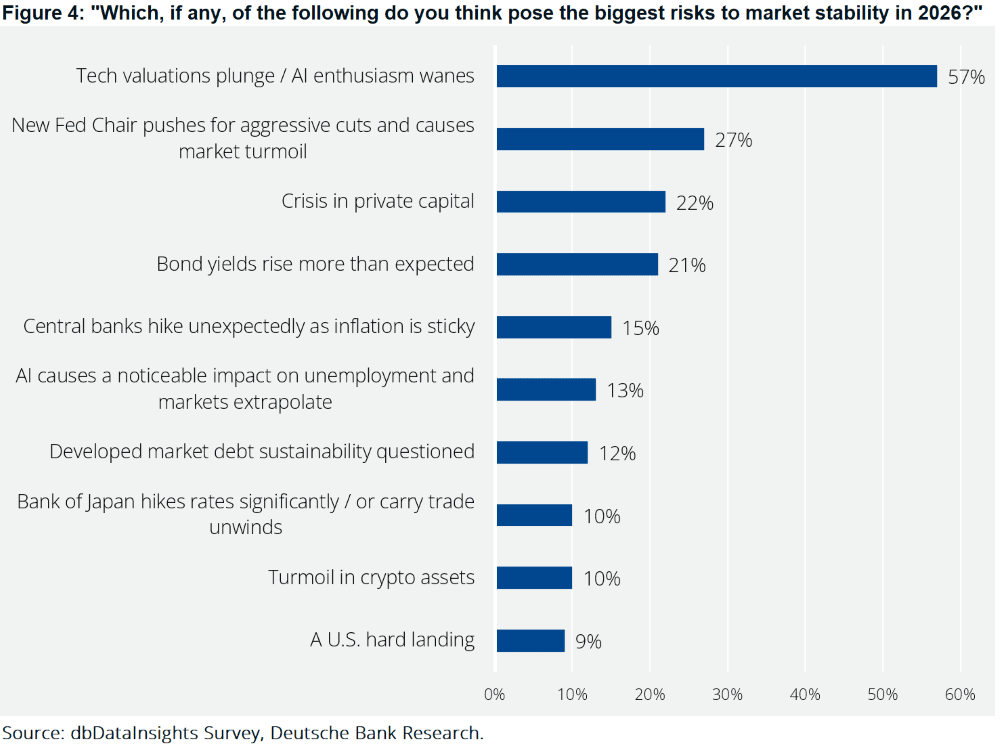

In terms of headwinds, AI exuberance in 2025 led to a run-up in mega-cap tech valuations, and if the big tech companies sneeze, the whole market could catch a cold. For example, if the “Magnificent 7” stocks each decline 20%, even if all the other companies in the S&P 500 Index are flat, the overall S&P 500 Index would fall 8%. While these mega-cap technology companies generate very strong cash flows, their valuations could still come under pressure if China were to meaningfully accelerate the release of competitive, low-cost open-source LLMs, weakening U.S. firms’ perceived competitive moats and triggering a reassessment of U.S. tech valuations. Also, more generally, ROI on AI investment is likely to disappoint lofty expectations at least early on, and economic growth more broadly is decelerating from around 3% in 2025 to around 2% in 2026.

Figure 4 below depicts the results of a survey of market participants and their assessments of the largest risks facing markets this year.

A final risk is elevated investor expectations. The S&P 500 Index has delivered double-digit returns in six of the past seven years, an unusually strong stretch by historical standards. Markets do not compound at this pace indefinitely, and return expectations should be tempered in light of this backdrop.

Federal Reserve Chair Jerome Powell’s term expires in May, requiring President Trump to nominate a successor subject to Senate confirmation. Earlier in the year, markets anticipated a more dovish nominee aligned with faster rate cuts. More recently, however, heightened scrutiny around Federal Reserve independence has complicated that outlook.

Ongoing political and legal pressure on the Fed has increased the likelihood of a more contentious confirmation process, potentially narrowing the range of acceptable nominees. While the ultimate policy direction remains uncertain, the transition introduces additional ambiguity around the future path of monetary policy. That uncertainty, in turn, raises the risk of episodic market volatility, particularly if expectations for rapid easing become misaligned with political or institutional constraints.

President Trump has pursued a more interventionist foreign policy than the isolationist posture that characterized much of his first term. Over the past year, U.S. actions have reflected a greater willingness to project power abroad, signaling a shift in how the administration seeks to advance strategic and economic interests.

While recent intervention in Venezuela is unlikely to materially affect markets in the near term, it could have longer-term implications for energy prices. Venezuelan oil production is expected to increase meaningfully over the next several years, which combined with slowing global demand growth, could contribute to lower oil and gas prices for longer.

More importantly for markets, major powers appear to be embracing a “spheres of influence” framework, taking a more active role within their immediate regions. The U.S. approach to Venezuela may shape how Russia frames Ukraine and how China approaches Taiwan, adding important context to the evolving U.S.-China rivalry. This shift also suggests a change in foreign policy tools. While tariffs were used in 2025 to leverage the uniquely powerful U.S. consumer base and restrict access for export-reliant economies, they may play a smaller role going forward. Instead, coercive diplomacy is likely to take precedence, including threats to withdraw security guarantees, limit intelligence sharing, restrict access to sensitive technologies, or block NATO membership.

Within portfolios, we are roughly neutral on AI exposure following fourth-quarter profit-taking. Overall portfolio quality remains high; a bias we intend to maintain given elevated equity valuations and tight credit spreads.

From a sector perspective, we would like to add selectively to Consumer Discretionary, though attractive opportunities remain limited. We continue to hold an underweight to enterprise software. Given the current level of uncertainty and prevailing interest rates, we do not expect to add small-cap exposure in the near term.

We trimmed international equities last quarter but would look to add back exposure if high-quality companies abroad experience meaningful weakness. While currency translation can complicate international allocations, a stronger dollar should expand the opportunity set.

Finally, fixed income, particularly high-quality corporate bonds and intermediate duration Treasuries, offers compelling risk adjusted returns. We may look to increase exposure here and modestly extend portfolio duration.

Markets enter 2026 supported by solid economic fundamentals, moderating inflation, and policy tailwinds that should be most visible early in the year. Strong corporate earnings and fiscal support are likely to help offset elevated valuations in the near term, even as economic growth cools from last year’s above-trend pace.

As the year progresses, visibility may become less clear. Slower growth, high investor expectations, and uncertainty around monetary policy leadership and geopolitics increase the likelihood of periodic volatility, particularly in the second half of the year. Historically, these conditions tend to reward disciplined investors who remain focused on fundamentals rather than short-term market noise.

In this environment, we believe diversified portfolios, an emphasis on quality, and flexibility in positioning remain essential. While markets are unlikely to move in a straight line, thoughtful allocation and patience should remain well rewarded.

In this environment, we believe diversified portfolios, an emphasis on quality, and flexibility in positioning remain essential. While markets are unlikely to move in a straight line, thoughtful allocation and patience should remain well rewarded.

We appreciate your trust and partnership. Please reach out if you would like to discuss your portfolio or the outlook in more detail.

Sincerely,

Leeward Financial Partners