Leeward Investment Team

U.S. equities staged a dramatic turnaround in the second quarter, with the S&P 500 climbing to new record highs and delivering a total return of +10.8%. This more than offset the first quarter’s -4.6% decline, bringing year-to-date performance to +6.1%. The path, however, was far from smooth. The quarter opened with a sharp 11.2% selloff over just six trading days following the Trump administration’s proposal for broad-based tariffs affecting nearly all global trading partners. From the April 8th lows, the S&P 500 rallied 25% through quarter-end. The reversal was swift and happened more quickly than anticipated, fueled by a series of supportive developments: delays in tariff implementation, improving news flow on trade negotiations, cooler inflation data, easing geopolitical tensions, and solid corporate earnings. Together, these factors helped restore market confidence and propelled equities to a strong first-half finish.

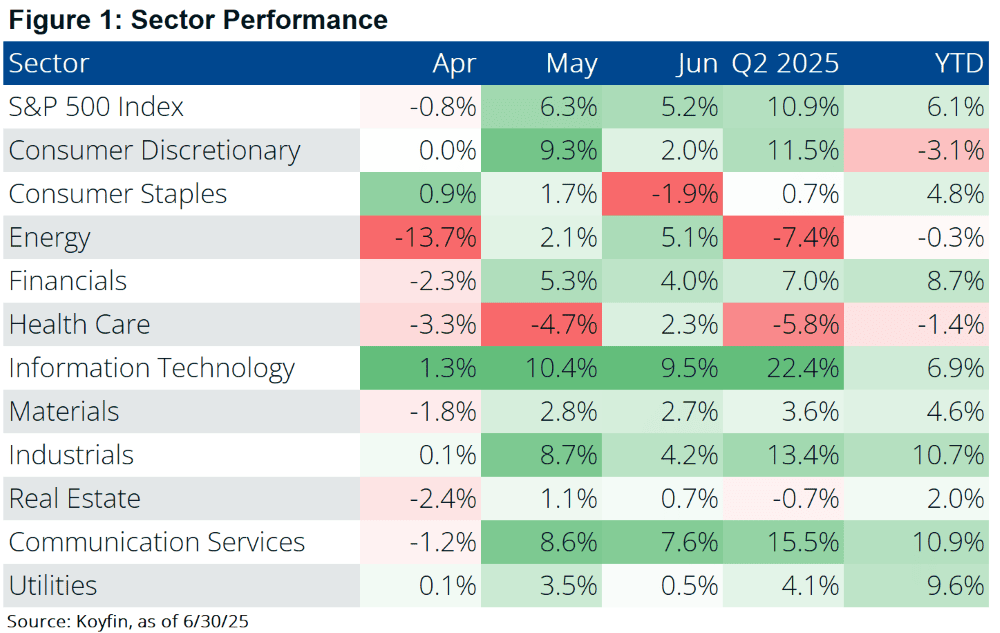

A “techtonic” shift defined the second quarter for U.S. equities, as Information Technology (+22.4%) and Communication Services (+15.5%) reclaimed leadership after ranking among the weakest sectors in Q1. Defensive and energy-related sectors had led earlier in the year, as investors rotated toward quality amid rising geopolitical tensions. Renewed enthusiasm for tech was fueled by continued AI integration, early excitement around quantum computing, expectations for increased infrastructure spending, and short-term technical momentum.

Small-cap stocks (+8.5%) underperformed large-caps (+10.8%) and remain negative year-to-date (-1.9%), as the prevailing interest rate environment continues to favor larger, more capital-efficient companies.

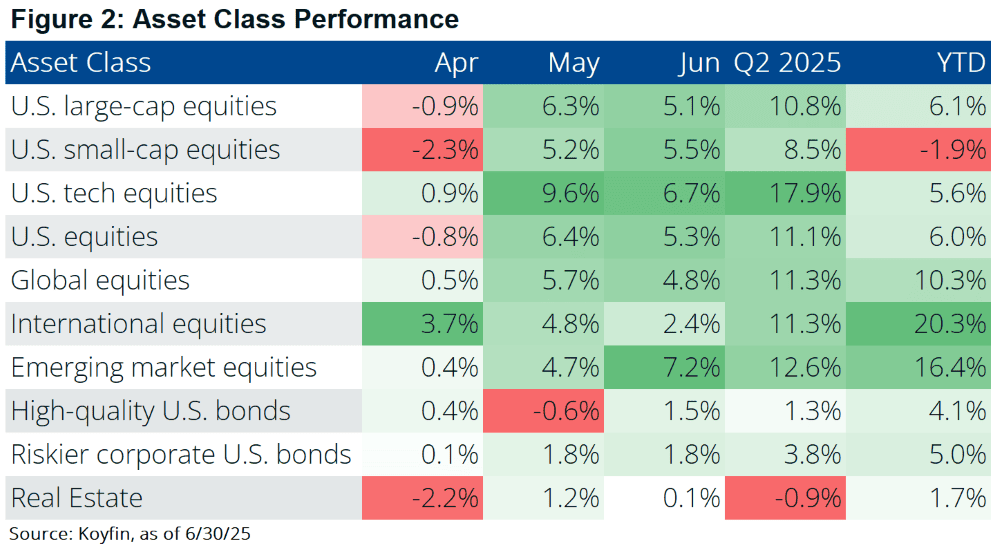

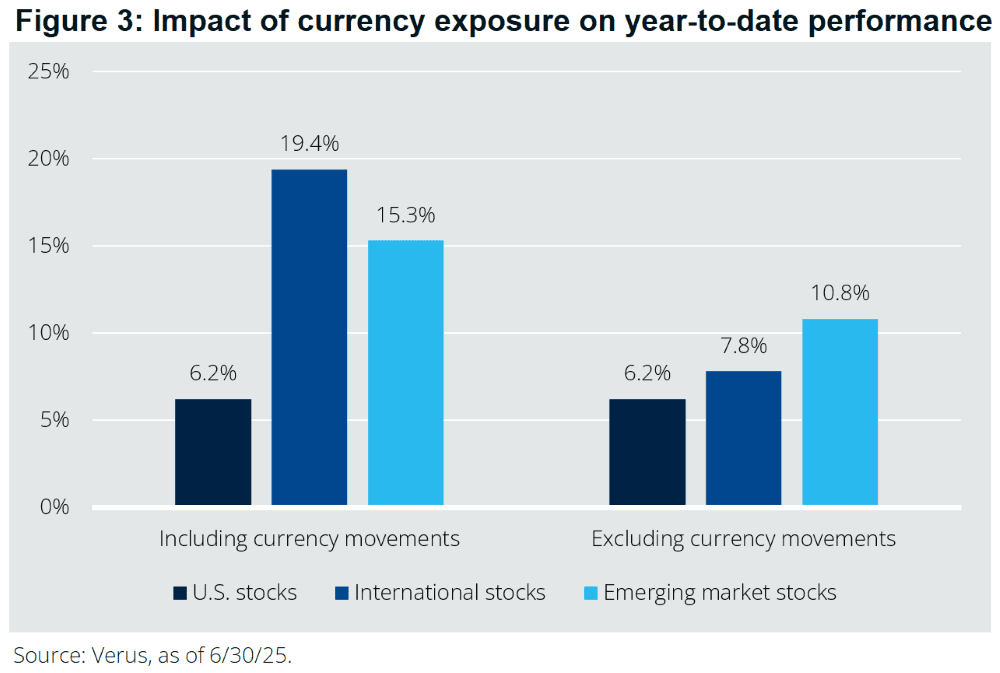

Much has been made of international equities’ year-to-date outperformance versus U.S. equities (20.3% vs. 6.1% in Figure 2 below), but most of the gap is attributable to foreign currency appreciation - particularly the euro (+13.4%), pound sterling (+9.4%), and yen (+8.8%) versus the dollar.

But, when you strip out currency effects (Figure 3), international equities have outperformed by less than 2%. That gap has already begun to narrow in recent weeks as the dollar has rebounded. Given the relatively high level of U.S. interest rates compared to Europe and Japan, we expect dollar strength to persist and international equity performance to moderate. That said, a key risk to this view is the growing concern that persistent U.S. deficits could undermine confidence in the dollar, potentially reversing its recent gains.

In fixed income, the best returns came from shorter-duration, lower-quality corporate bonds (+3.5%), while long-term government bonds lagged (-1.5%) as yields on the 30-year Treasury rose toward 5%. Shorter-term yields, meanwhile, moved mostly sideways.

One of the defining themes of 2025 has been the disconnect between soft and hard economic data. Consumer sentiment remains fragile, even as headline economic indicators suggest underlying resilience.

For example, the University of Michigan’s Consumer Sentiment Index ticked up in June but had declined for five consecutive months prior. Survey responses suggest consumers remain wary, concerned about persistent inflation and the potential for an economic slowdown. Business surveys reflect similar caution: recent readings from the Institute for Supply Management show mild contraction in manufacturing and sluggish growth in services, where cost pressures have limited gains in new orders and overall activity.

In contrast, hard data has painted a more constructive picture. The labor market remains tight, with unemployment holding at 4.2% and job growth consistently beating expectations. Non-farm payrolls rose by an average of 154,000 per month in Q2, outpacing consensus estimates of 123,000. While that’s below the long-term average of 180,000, it’s a solid outcome given already-low unemployment and a relatively high labor force participation rate.

Inflation data has also been more benign than expected. Headline CPI came in below expectations in April, May, and June, with year-over-year inflation ending the quarter at 2.4%, and core inflation (excluding food and energy) at 2.8%. So far, the feared re-acceleration in inflation has not materialized. One possible explanation: some companies appear to be absorbing the cost of new tariffs—at least temporarily—to protect market share and maintain competitive pricing.

The Federal Reserve operates under a dual mandate: to promote full employment and maintain price stability - defined as 2% average inflation over time. So where do things stand on each front?

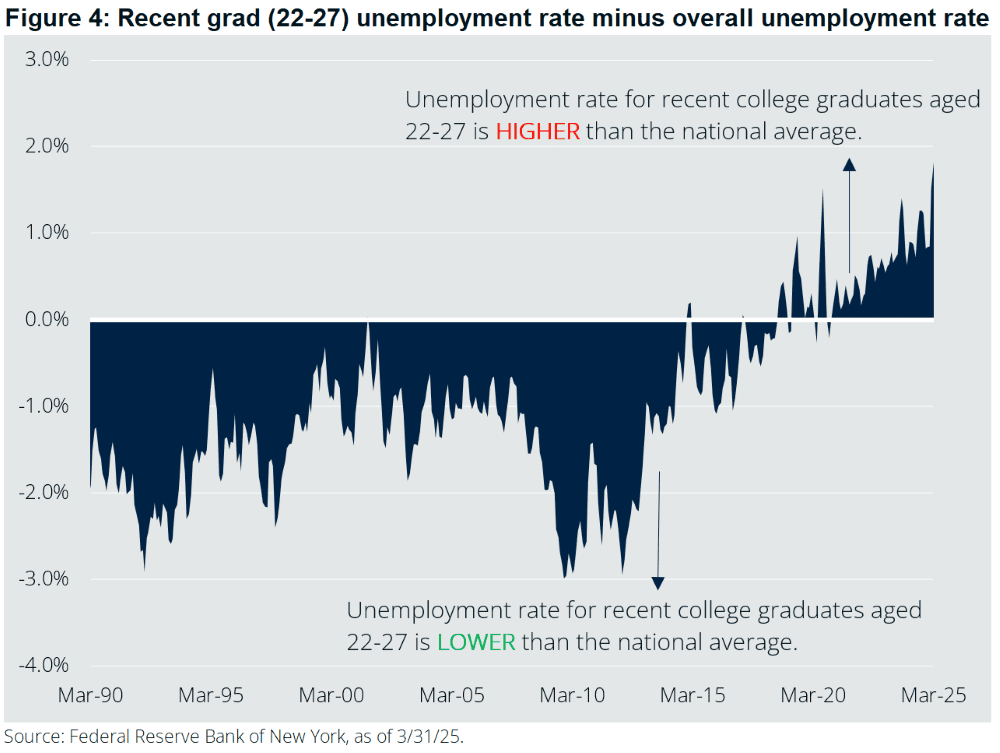

On the employment side, the labor market remains tight. Unemployment sits at 4.2%, roughly 1% above recent lows but still below long-term averages. However, not all groups are benefiting equally. In Figure 4 below, you can see that college graduates aged 22-27 are now experiencing higher levels of unemployment than the national average - a reversal from historical norms where recent college graduates typically experienced jobless rates about 1% below the national average. As of March, recent college graduates were facing an unemployment rate of 5.8%, a level 1.6% above the nationwide rate. The divergence may reflect structural changes, such as the early effects of AI adoption, which could be reducing the demand for entry-level, degree-based roles. Still, taken in aggregate, labor market conditions remain relatively strong and don't clearly warrant a rate cut on their own.

On the inflation front, there’s been no meaningful acceleration despite the announcement of new tariffs. In fact, inflation has continued to surprise to the downside. Headline CPI is tracking at 2.4%, while core inflation (excluding food and energy) is at 2.8%—still above target, but trending lower. With additional price pressures likely to emerge in the second half of the year, inflation remains the Fed’s primary constraint.

Taken together, the case for rate cuts remains mixed. Labor markets may be cooling modestly at the margins, but inflation is still elevated relative to the Fed’s 2% target. Against this backdrop, the Fed’s cautious, data-dependent posture appears justified.

Recent criticism from the Trump administration has centered on the Fed’s reluctance to cut rates while other central banks have moved more aggressively. But this comparison oversimplifies the situation and ignores the reality that growth and inflation dynamics differ meaningfully across countries. Ironically, such political pressure may make the Fed more cautious, not less - raising the threshold for action to safeguard its independence and credibility. For now, markets are pricing in two rate cuts by year-end, likely in September and December, which would bring the Fed Funds rate to approximately 4% heading into 2026.

On July 4th, President Trump signed the One Big Beautiful Bill Act (OBBBA) into law using the budget Reconciliation process. This procedure allows certain fiscal legislation to pass the Senate with a simple majority and without risk of filibuster, though it must be limited to tax and budgetary matters.

Republican leadership has indicated OBBBA is the first of three planned Reconciliation bills, with the next two expected in early October (alongside the FY 2026 budget) and again in Spring 2026.

Key provisions of OBBBA:

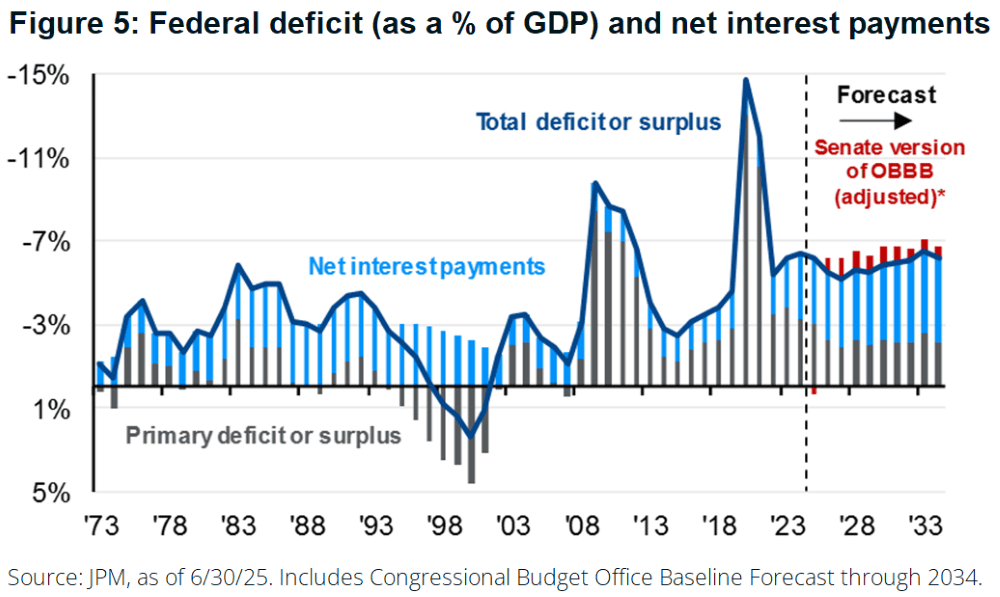

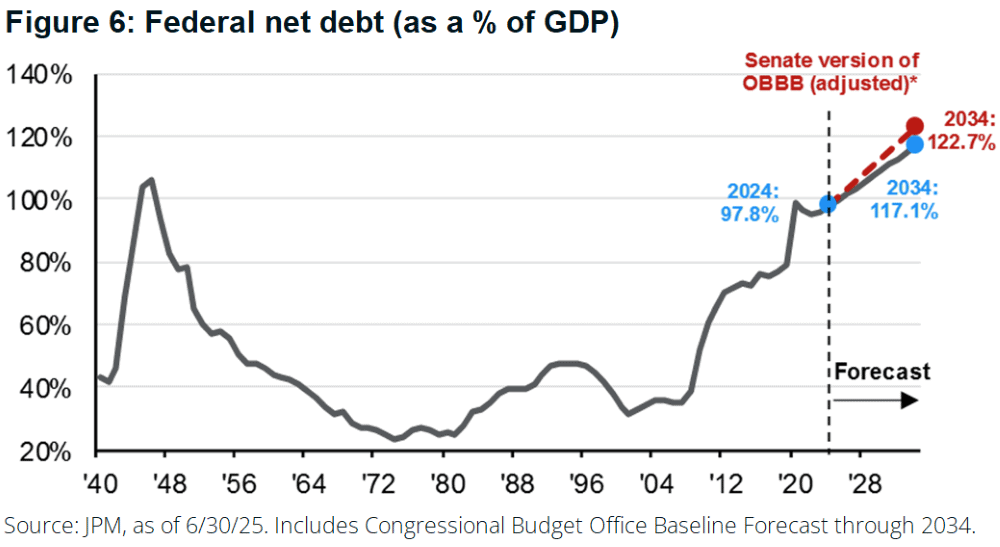

Current consensus estimates suggest OBBBA will boost long-run GDP growth by about 1.2%, though the growth is expected to offset only about 20% of the projected $5 trillion in lost revenue over 10 years. After interest costs, the bill is projected to increase the federal deficit by $3.8 trillion and raise the debt-to-GDP ratio by 2034 to 123-127%, compared to a baseline of 117% without the bill. Figures 5 and 6 below depict the projected impact of OBBBA on the annual deficit and overall national debt, respectively.

Importantly, deficit spending is front-loaded, while budget cuts are scheduled for later years. Tax cuts provide early benefits to the middle class, but over time, cuts will skew more toward the top 10% of earners. The full scope of the bill’s impact will become clearer as the Treasury Department issues implementation guidance later this fall.

One of the defining features of today’s market environment is a tendency for investors and businesses to underreact to new developments until the shift becomes too big to ignore, triggering abrupt and sometimes disruptive adjustments. This behavioral lag can create a misleading sense of calm. While we’re not sounding alarm bells today, we’re closely monitoring for signs that policy changes are beginning to alter the economic landscape.

Tariffs and inflation:

Tariffs have so far failed to produce the kind of inflation many expected, but the lack of price pressure may be more a function of timing than true immunity. Many retailers have absorbed costs or sold through old inventory without price hikes in an attempt to maintain competitive pricing. If higher tariffs remain in place - and the President’s new tariffs on imports from Brazil, Canada, Mexico, the EU, and copper go into effect August 1 – companies will eventually have to start passing through those price increases. In 2022, “supply-side disruptions” provided cloud cover for many corporations to hike prices, feeding into a self-reinforcing inflation cycle. The risk isn’t that inflation has stayed low - it’s that expectations are being anchored to an aged reality. Any inflation pickup will reduce the likelihood of Fed cuts, and increase the likelihood of a higher rate environment for longer.

Immigration policy and the labor market:

The labor market has held up well despite aggressive immigration crackdowns, but here, too, lag effects are masking future risks. Stricter border enforcement has resulted in unauthorized immigrant encounters falling from 250,000 per month in late 2023 to just 12,000 since February. ICE detentions rose from 22,000 in January to 35,000 in June, largely affecting long-settled individuals who were likely in the labor force. Visa issuance trends point to a further drop in future labor supply. The recently passed OBBBA ramps up immigration enforcement dramatically, with 10,000 new ICE agents and billions in detention infrastructure, potentially driving annual net immigration down to a fraction of historical norms. That would mark a sharp departure from the 1 million-plus annual inflows we’ve seen for decades. While headline employment numbers still look strong, labor supply could begin to contract meaningfully over the next 6–12 months.

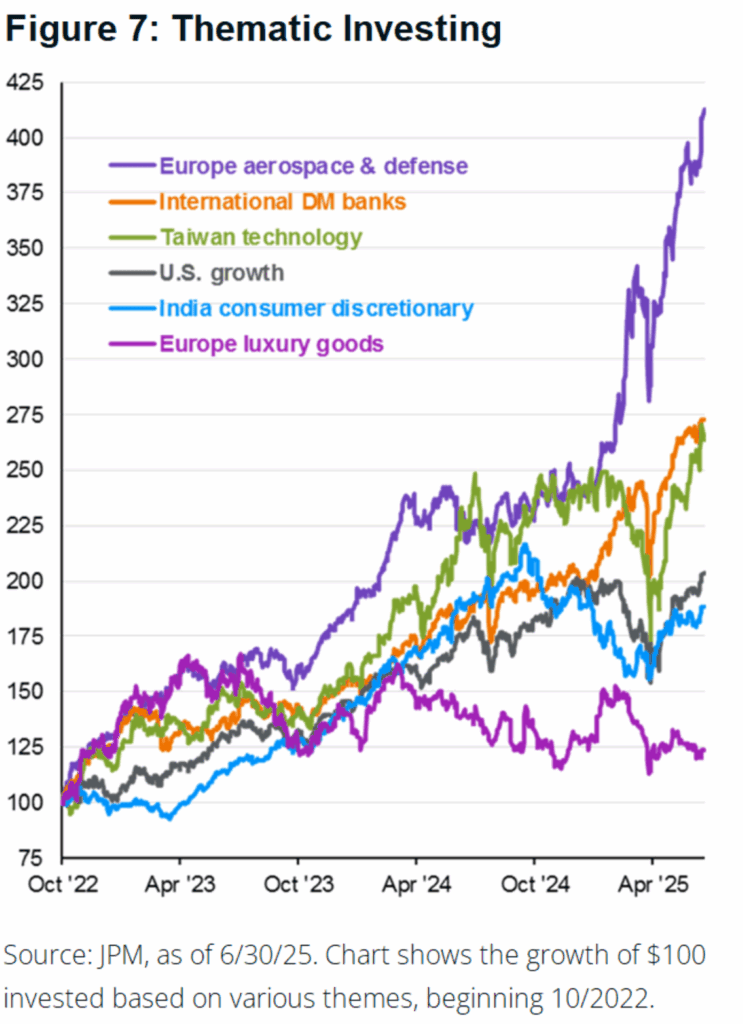

Tensions in the Middle East—particularly among the U.S., Israel, and Iran—have de-escalated for now, with market impacts mostly short-lived and limited to commodity prices. In Europe, the war in Ukraine continues with no clear resolution in sight. The U.S. recently authorized the delivery of Patriot missile systems to Ukraine, reflecting an ongoing commitment to the conflict. More broadly, NATO countries have begun increasing defense spending, which has contributed to rising valuations among European defense firms and a modest improvement in the region’s investment outlook.

Meanwhile, U.S.-China relations have been constructive in recent months, though the possibility of renewed tensions or long-term economic decoupling remains on the radar.

As a quick recap, we moved to a more defensive posture in March and began unwinding that positioning in three stages: the first in early April, the second in mid-April, and the third in late June.

On the equity side, recent changes focused on trimming exposure to the Consumer Staples and Health Care sectors, and reallocating to Information Technology, Communication Services, and Financials. We also brought Industrials back to a neutral weight, while refining our holdings to emphasize AI exposure.

In fixed income, we reduced both overall bond exposure and interest rate duration, as the likelihood of materially lower rates in the near term has diminished.

At this stage, we’re positioned for the market to move higher. Unless the backdrop changes substantially, we expect to do much less trading in the third quarter.

As we move through the rest of the year, staying focused on the hard data—and what it signals about the Fed’s next steps—will be key. The rally since April has been swift, and some digestion is natural before markets can meaningfully push higher. How far we go from here will depend in part on how tariffs affect inflation, business and consumer spending, and ultimately, corporate earnings.

Our initial forecast for the year called for mid-single-digit returns. That outlook has improved modestly, though, as we've discussed, there are still risks worth monitoring. On balance, we remain cautiously optimistic.

We thank you for your trust and partnership.

Sincerely,

Leeward Financial Partners