Leeward Investment Team

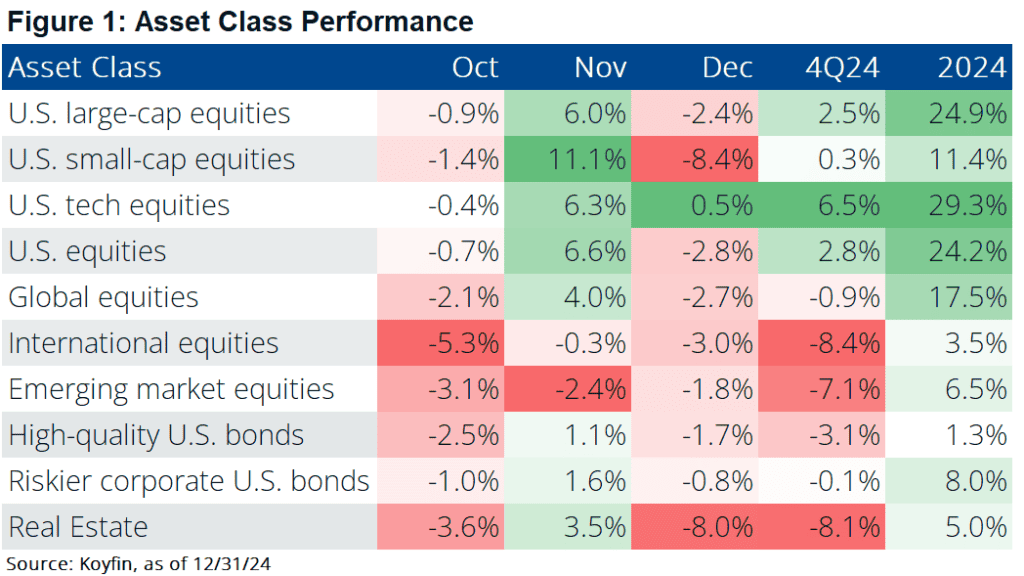

The U.S. stock market delivered a second straight year of +20% gains in 2024, only the third time this has happened in the last century. Meanwhile, bonds delivered another year of below-trend returns, producing a tepid 1% increase for the year. The culprit in both cases was a strong U.S. economy, which grew almost 3% in 2024.

Recent domestic growth has been remarkable. Consumer confidence is at its highest level in 18 months. U.S. economic output hasn't been this strong since early 2022. Retail sales topped estimates in the fourth quarter, unemployment continues to hover around 4%, and inflation has moderated. The Fed began to cut rates, although not as fast as expected, and the Presidential election refocused investors on the impact fiscal policy will have on markets in the future. As we enter 2025, the economy remains on sound footing. Markets will be beholden to fiscal policy's impact on the economy to start the year, but ultimately, the promise of strong corporate earnings and continued innovation will drive markets higher in 2025.

U.S. equity market exceptionalism defined the fourth quarter, with domestic stocks extending their substantial year-to-date gains while European and Asian markets struggled amid mounting risks.

The S&P 500's 2.5% quarterly return pushed its 2024 gain to 24.9%. After October's range-bound trading, stocks rallied in November following Donald Trump's election, driven by optimism around proposed deregulation and reflationary fiscal policy. However, the index retreated 2.4% in December as concerns emerged that pro-growth policies under Trump 2.0 could fuel inflation and keep interest rates elevated. Small-caps proved especially volatile, with the Russell 2000 surging 11.1% in November before falling 8.4% in December to end the quarter flat. Year-over-year earnings growth reached an estimated 12% by year-end – potentially the highest since Q4 2021 – supported by productivity gains.

International equities underperformed (MSCI EAFE -8.4%) despite falling inflation and central bank rate cuts. France's market declined 10.5% after Prime Minister Barnier's no-confidence resignation, while Japan (-4.7%) saw its currency depreciate over 10% against the dollar in 2024 due to interest rate differentials. International stocks are now trading at a 40% discount to U.S. valuations, which has occurred only 5% of the time in the last two decades. However, we view these steep discounts as signs of impairment rather than buying opportunities.

Emerging markets fell 7.3% in Q4, dragged down by South Korea (-18.5%) following its presidential impeachment crisis and Brazil (-20.1%) where rates jumped 1.00% to 12.25%. China's modest 2.8% decline masked serious concerns: plunging 10-year bond yields signal rising deflation risks, 70% of household wealth remains trapped in overvalued real estate, and demographic headwinds persist as the population continues to fall and is expected to drop by over 400 million by 2070.

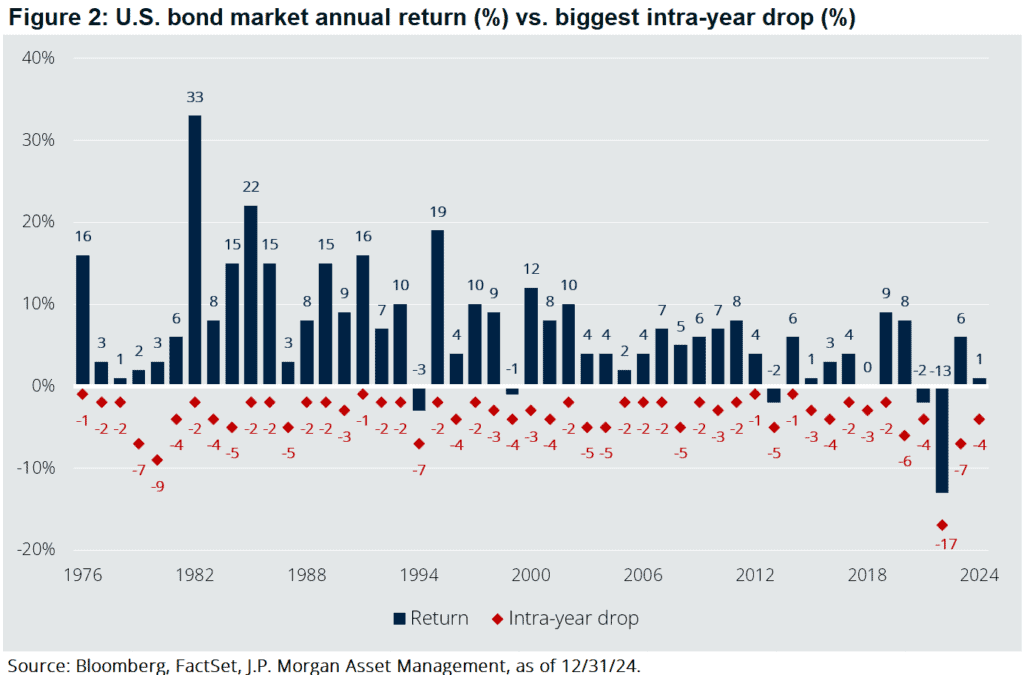

The U.S. bond market's momentum in 2024 was disrupted by the Q4 Fed pivot, driving interest rates higher. The Bloomberg U.S. Aggregate Index fell 3.1% in the fourth quarter, limiting full-year returns to 1.3% and disappointing balanced portfolio investors. Figure 2 below shows that in four of the last seven years, bonds have traded basically flat or lower – far from what has been the norm for most of the last 50 years.

Current bond yields suggest solid forward-looking returns, provided inflation remains stable and interest rates don't surge. This presents an opportunity for investors willing to take a strategic, long-term view of fixed-income investments, contingent upon maintaining a measured economic environment.

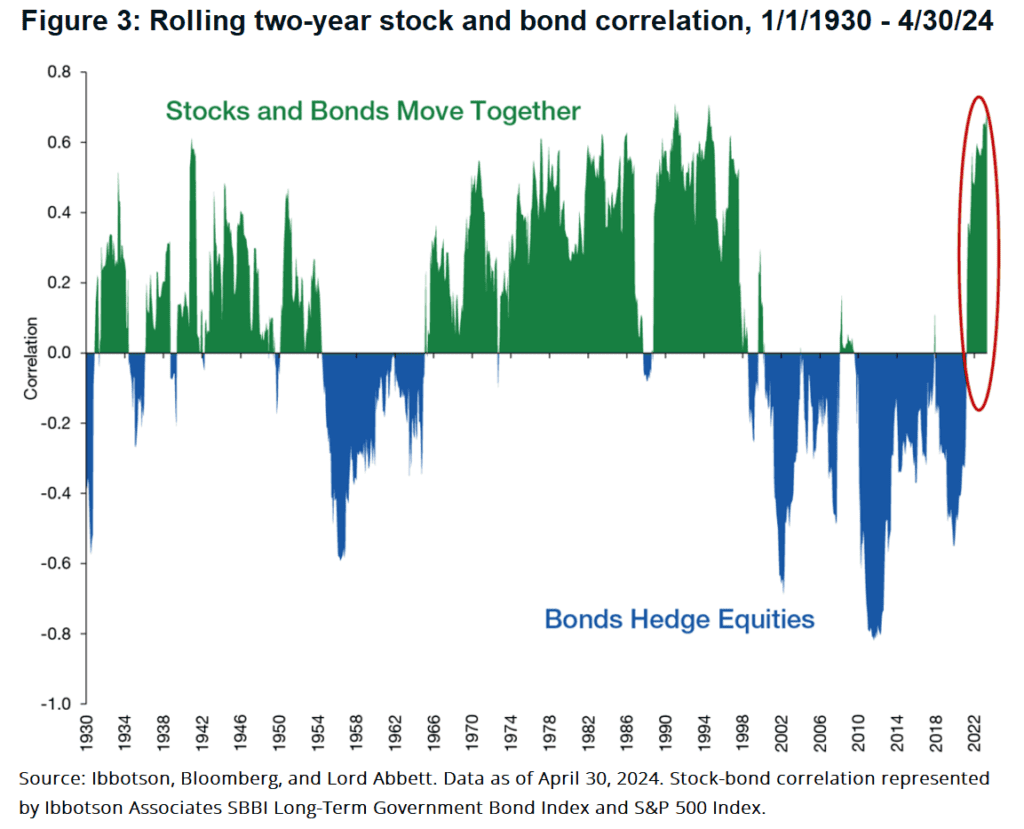

The traditional stock-bond relationship is transforming. Historically, bonds provided critical downside protection during market declines and maintained a negative correlation with stocks that made them an essential diversification tool. However, recent years have seen this correlation shift, with stocks and bonds increasingly moving in tandem, echoing similar patterns during high-inflation periods from 1967 to 1998. The recent return to a positive stock-bond correlation is depicted in Figure 3 below.

Investors can no longer view bonds as simple "crash insurance." Instead, they should be understood as a lower-volatility alternative to stocks, offering a more predictable return profile with a defendable baseline of performance. This requires a more nuanced approach to asset allocation that recognizes the evolving dynamics of financial markets while still appreciating the fundamental value of fixed-income investments.

We generally advise clients not to get too excited in January. Fourth-quarter earnings will be strong this year, but full-year 2025 guidance will be more tempered. We’ll want to see what those numbers look like over the next month before making further adjustments to client portfolios. Earnings estimates will move lower before eventually improving later in the year.

To start the year, we’ve seen slight reversions in the marketplace, with Energy and Materials outperforming Technology, Communication Services, and Financials. These trends will reverse as we enter corporate earnings season in late January and February. Strong corporate earnings and positive commentary from management teams should entice investors to return to sectors with more substantial growth and better fundamentals, much like we saw in early 2024.

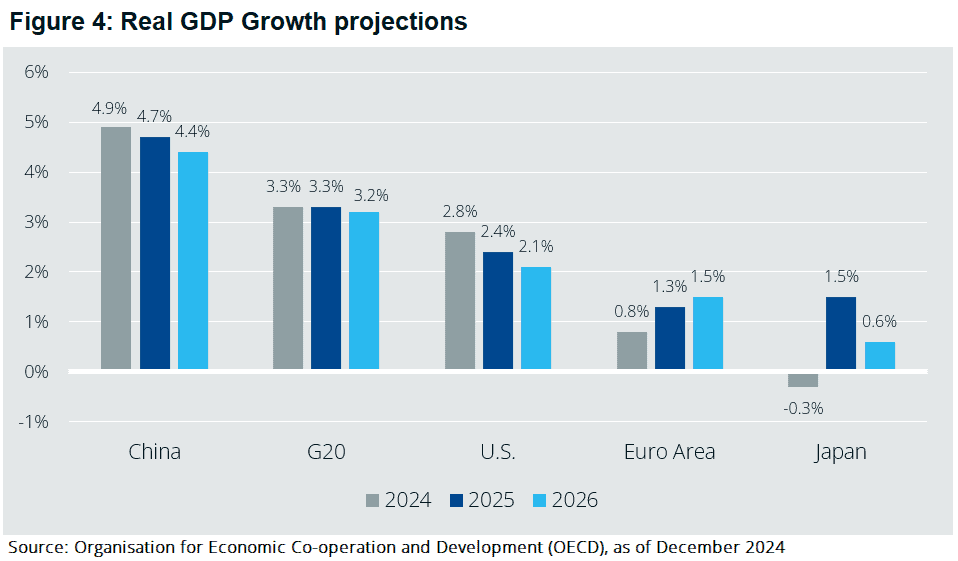

The global economy remains resilient, with inflation continuing to moderate, unemployment remaining at or near historical lows, and global trade beginning to revive. Falling inflation is providing a boost to household income growth and spending, although consumer confidence has yet to recover to pre-pandemic levels in many countries.

The OECD is projecting global GDP growth at 3.2% in 2024, and 3.3% in both 2025 and 2026, with the emerging Asian nations driving most of that growth. The United States is projected to grow GDP at a clip of 2.8% in 2024, 2.4% in 2025, and 2.1% in 2026 – below many emerging economies but ahead of most of Europe and Japan.

While unemployment remains low, there are fewer job openings at present, meaning those that are unemployed are staying unemployed for longer, and the rate at which people are quitting their jobs is at a multi-year low. These data all indicate a slowing but solid labor market domestically.

Headline inflation has continued to move lower and finished the year just below 3%, driven by a slow-and-steady disinflation of shelter prices (i.e. rent). Absent any major geopolitical crisis like an oil price shock, inflation will likely move around the 2.5-3.5% range for the next few years. Historical data suggest that if food and energy prices can fall relative to the prices of other goods and services, consumer confidence could improve, even if the overall inflation rate remains the same.

Global political upheaval has intensified, with major leadership changes occurring across the world. In Canada, Prime Minister Justin Trudeau resigned, while South Korean President Yoon was impeached and subsequently imprisoned. In Europe, Germany's far-right Alternative fur Deutschland (AfD) party gains momentum ahead of February 23 elections, while France faces potential electoral disruption with Marine le Pen leading current polls. Meanwhile, mounting scandals in the U.K. have put pressure on the viability of the Labour government under Prime Minister Keir Starmer.

Beyond domestic politics the Ukraine conflict continues, and despite optimism around the recent ceasefire in Gaza, Assad's fall in Syria threatens regional stability, particularly regarding Iran and Russia's responses. While immediate Chinese aggression toward Taiwan seems unlikely, historical patterns suggest struggling regimes may pursue military action to deflect from internal economic challenges.

Monetary policy remains a large risk. Whereas four months ago the expectation was that the Federal Reserve would make five or six interest rate cuts in 2025, the current number has faded to just one, or maybe two cuts. In December, Fed Chair Powell noted the uncertainty about the fiscal outlook, and that they would be slowing down and waiting for further data to confirm sustained progress on inflation.

Powell's approach is akin to driving at night when it suddenly gets foggy - the prudent move is to slow down and wait for the fog to clear before speeding up again. This shift in strategy is already priced into markets, and the primary risk is now a meaningful inflation resurgence. In such a scenario, the Fed might pivot from its current "wait-and-see" approach with a bias toward cutting, to a position potentially favoring rate hikes. While we don't anticipate this happening soon, such a shift would necessitate asset price adjustments lower.

Importantly, the Fed remains in a stronger position compared to developed market peers. U.S. interest rates are likely to stay elevated relative to Europe and Japan, which suggests the U.S. dollar will continue to strengthen. This dynamic would support U.S. consumption while creating challenges for U.S. exporters, commodity importers, and emerging market nations with dollar-denominated debt.

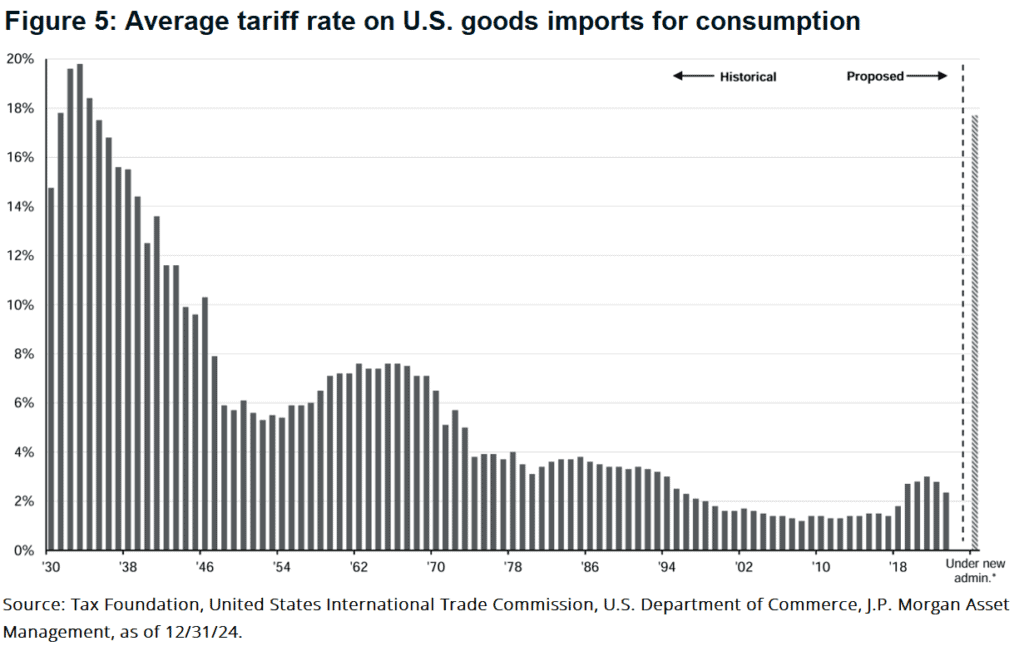

Global trade protectionism, particularly the President’s proposed tariffs, poses a significant risk for inflation. While typical tariffs of 3-5% have minimal price impact, the administration's suggested rates would be substantially higher. We take the President’s tariff rhetoric "seriously, not literally" - seriously in that tariffs will be a key priority, but not literally in that rates go as high as the administration has suggested, which would be in line with the highest rates since World War II. As you can see in Figure 5 below, if current tariff proposals are implemented, the average tariff rate on imported goods would jump from around 2% to nearly 18%, a level last seen in the late 1930s.

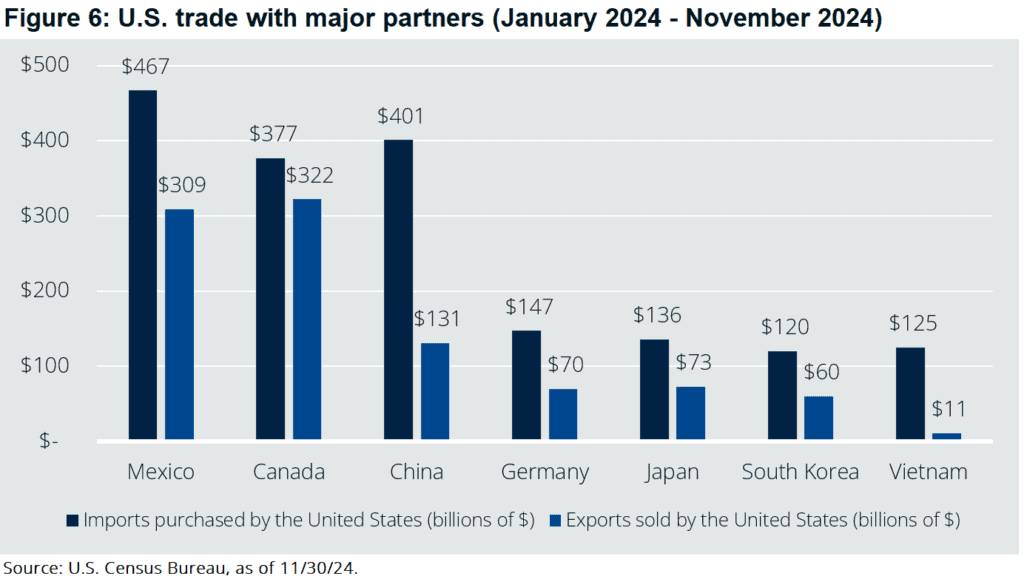

While broad-based tariffs have been threatened, a more strategic approach will likely target countries that export significantly to the U.S. while importing comparatively less. The below chart of U.S. trading partners (Figure 6) reveals substantial trade deficits with countries like China, Mexico, Germany, and Japan, positioning them as primary targets for future tariff negotiations. The magnitude of these trade imbalances means U.S. tariffs would disproportionately affect foreign exporters compared to the potential impact of retaliatory tariffs on U.S. domestic exporters. This asymmetry will provide stronger negotiating leverage for the U.S. team in trade discussions.

Immigration policy could stoke inflationary pressure. The likely approach from the new administration will involve "self-deportation" strategies designed to make staying in the U.S. more challenging for undocumented individuals. Potential tactics include penalizing landlords who rent to undocumented immigrants, restricting healthcare access, and complicating international money transfers.

The economic risk is significant. The USDA estimates that 50-70% of U.S. farmworkers are undocumented. A mass exodus would devastate agricultural industries, creating substantial cost pressures in fruit, vegetable, and dairy sectors. These disruptions would directly translate to higher grocery prices and potentially undermine broader consumer confidence in the economic outlook.

After years of subdued M&A activity, the stage is set for robust dealmaking in 2025. Following the uptick in transactions in the back half of 2024, there is continued optimism about a shift to a pro-growth environment with less regulation. Deal volumes should increase by 15% this year, driven by intense pressure to deploy cash reserves, investor activist initiatives, and a push for top-line growth instead of share repurchases and dividends.

In an increasingly M&A-friendly environment, both acquirers and take-out companies become attractive investment candidates. Large technology companies are well-capitalized and will be able to add to their portfolios in 2025. On the take-out side, small-capitalization targets are already experiencing an uptick in investor interest as exit strategies for best-of-breed technology companies become more predictable.

Many of the investment themes from 2024 will carry over into 2025. The U.S. remains the most attractive market. European economies are weakening, Chinese instability continues, and a strong U.S. dollar makes emerging markets unattractive. At the sector level, artificial intelligence (AI) opportunities in Technology, Industrials, and AI-adjacent industries will continue to see above-average growth and will remain areas of focus. We continue to like Financials and anticipate adding exposure to the sector.

In the fourth quarter, we adjusted client portfolios. We shortened the duration in many fixed-income heavy accounts, adjusted our technology holdings, and swapped positions in the Healthcare and Consumer Discretionary sectors. We view these moves as optimizing portfolio holdings rather than actual repositioning.

Adjustments to positions in the new year will be driven by corporate earnings reports, announcements of new fiscal policy by the government, and opportunistic buying of best-of-breed companies in sectors that are out of favor. Our international exposure remains at multi-year lows. Once the strength in the U.S. stabilizes, we will evaluate if the timing is right to increase holdings in markets outside the U.S.

Bonds are oversold. However, we’d like to see additional data points confirm a turn downward in interest rates. If this happens, we will look to increase portfolio interest-rate exposure.

Markets have had extreme swings over the last three years. 2022 was a rough year, particularly in bonds. Both 2023 and 2024 were good years, and taken together, were historically good years. We expect 2025 to be more normal, where we experience positive returns in equities and fixed income but not the outsized returns of 2023 and 2024. The U.S. economy will grow above trend, rate cuts will be fewer, and yields will come down.

There is much work to be done between now and the end of the year. But when everything is said and done, we expect your investments to grow and account values to increase.

We thank you for your trust and partnership.

Sincerely,

Jim and Mike

jim@leewardfp.com

mike@leewardfp.com