Leeward Investment Team

Markets initially churned higher to start the quarter, but momentum faded once earnings season hit full gear. Lackluster company reports and slowing growth expectations were the main culprits that tempered enthusiasm.

August provided little relief with the Japanese Yen/U.S. dollar pair trade (see our note here), tanking markets in the first week of the middle month. As August wore on, supply-demand imbalances stabilized, and markets recovered. Tech star Nvidia <NVDA> reported a solid third quarter on August 27th, but many deemed forward guidance disappointing. September opened much like August, with a 5% drop, driven by weakening economic data and a lack of stock appreciation after Nvidia's report.

By mid-September, investors were in a holding pattern, waiting to see if the Federal Reserve Bank (Fed) would officially begin cutting rates. The Fed came through with a market-friendly 0.50% cut on September 18th, solidifying the consensus that the U.S. economy was not falling into a recession. Post-rate cuts, markets climbed higher and ended the third quarter in positive territory.

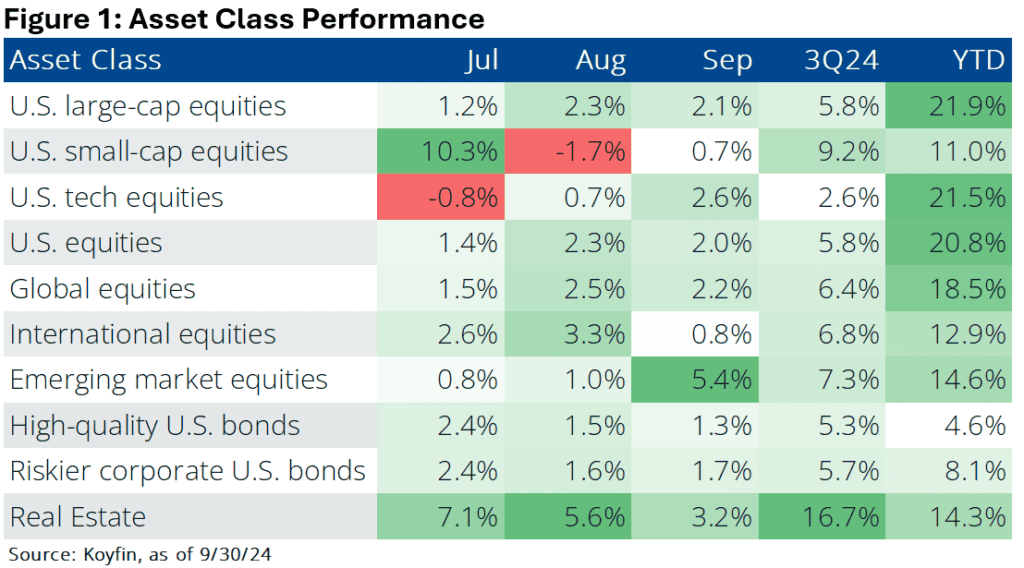

During the third quarter, markets experienced a broadening in performance across asset classes. Global equities, U.S. small-cap equities, bonds, and real estate performed well. Most notably, mega-cap technology leadership paused, with the NASDAQ 100 Index returning just 1.9%, and the tech sector returning 2.6%. (See Figure 1, below.)

Thankfully, with mega-cap taking a step back, small-cap companies grabbed the torch and advanced nearly 10%, making up some ground they had lost over a slow first half of the year. The German equity market (+10.5%) helped international stocks (+6.8%) to make up some ground on the U.S. market (+5.8%), but both remain meaningfully behind over the year-to-date. Emerging markets surged 7.3%, mainly in September, supercharged by the announcement of a "bazooka" of stimulus in China, including interest rate cuts, more lax reserve requirements for banks, and a flurry of fiscal support programs. The Chinese equity market, which many investors have viewed as uninvestable the last few years, rose 22.3% in Q3, and as of October 2nd, YTD gains stood at 48.1%.

Mounting expectations for a soft landing (defined as the economy slowing but not entering a recession) increased investor risk-appetite, supporting REITs (+16.7%), cyclical equity sectors including financials (+10.6%), and high-yield credit (+5.7%). Most encouragingly, bonds are doing their job once again. The U.S. bond market has generated total returns of around 5% year-to-date and is on track for its best performance since 2020.

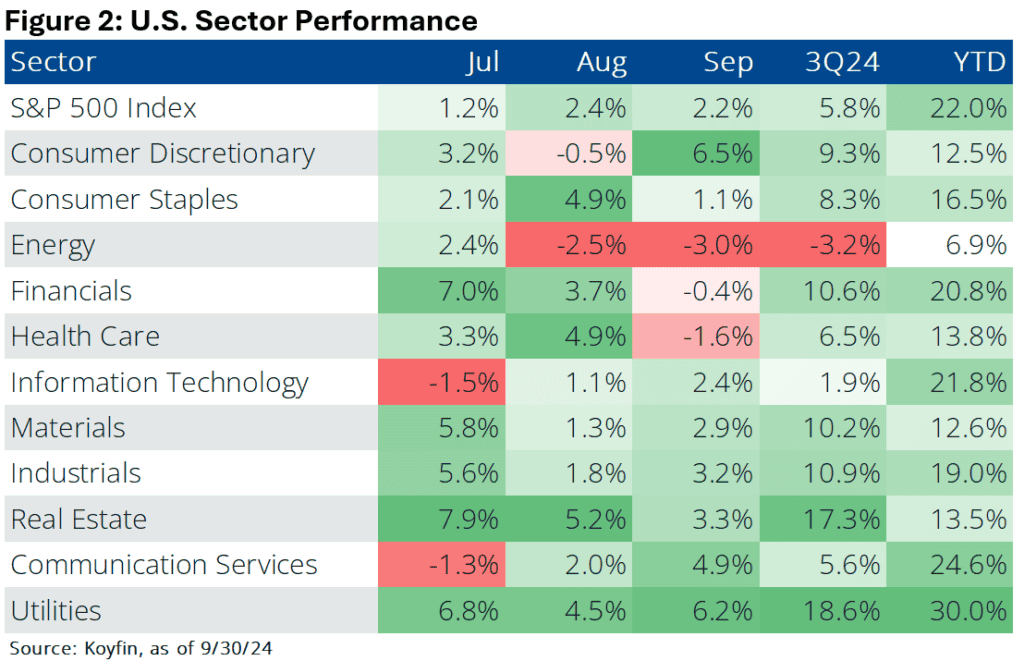

As we mentioned above, the change in leadership in the third quarter resulted in tech (+1.9%) and communication services (+5.6%) companies lagging more risk-favorable sectors such as financials (+10.6%), real estate (+17.3%), industrials (+10.9%), and materials (+10.2%). This phenomenon is called a “sector rotation” and is generally seen as a healthy market event. (See sector performance below, Figure 2.)

Interestingly, utilities—typically viewed as a defensive sector—were the top performers in Q3 (+18.6%) and are now the top performers year-to-date (+30.0%). Outperformance has been driven by an insatiable thirst for power from data centers supporting AI technologies. We expect these secular tailwinds to remain in place but are cautious about continued outperformance.

Energy, a smaller sector in the market, underperformed, falling -3.2% in Q3. Brent crude oil finished the quarter at $72/bbl, moving sideways over the last three years. Recent escalations in Iranian-Israeli tensions have pushed that number up a few dollars, but upside risks remain limited.

As we enter the fourth quarter, economic indicators have softened but remain well above pandemic levels. Unemployment is now at 4.2%, up 0.8% from its trough of 3.4%, but still well beneath the 50-year average of 6.2%. Layoffs have picked up to 1.6 million per month, up 200,000 from pandemic lows but still 200,000 beneath long-term averages. So, while we are seeing a slowdown, this slowdown appears healthy and measured.

Economic activity in the manufacturing sector contracted for the sixth consecutive month in September. Manufacturing activity shrinks in a slowing economy, making this data unalarming. The more significant services component of the economy has continued to expand in recent months, driven by new orders and business activity.

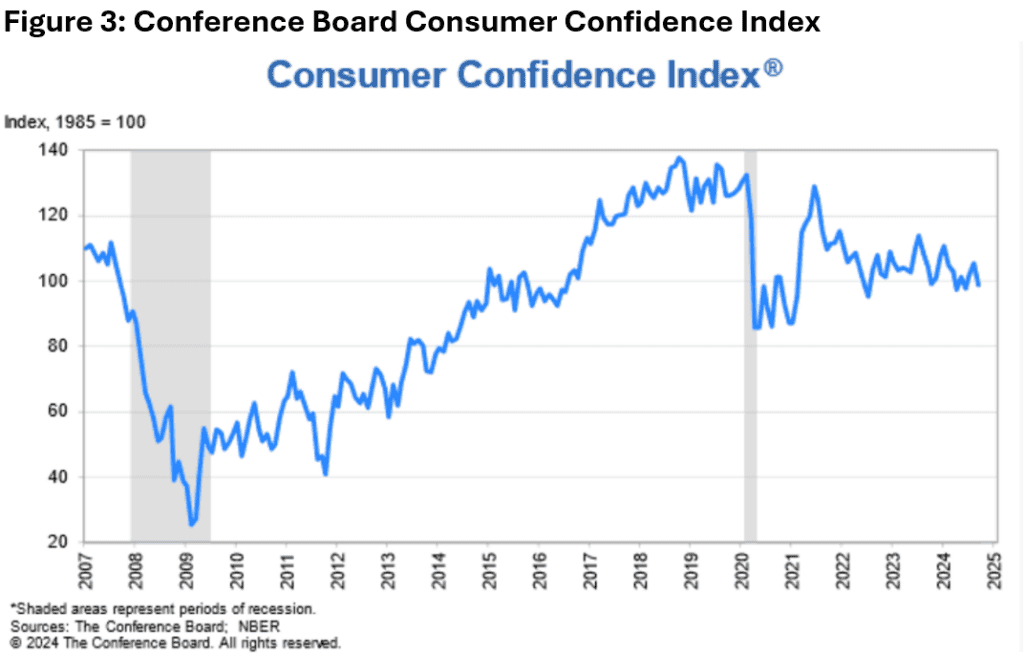

Consumer sentiment fell in September as fears grew about jobs and business conditions. The Conference Board's Consumer Confidence Index, a survey of current and future business conditions, slid to 98.7 in September, down from 105.6 in August. The deterioration was attributed to consumers' concerns about fewer working hours, slower payroll increases, and fewer job openings. (See Figure 3, below). Counterintuitively, it's often a great time to buy stocks when sentiment is depressed.

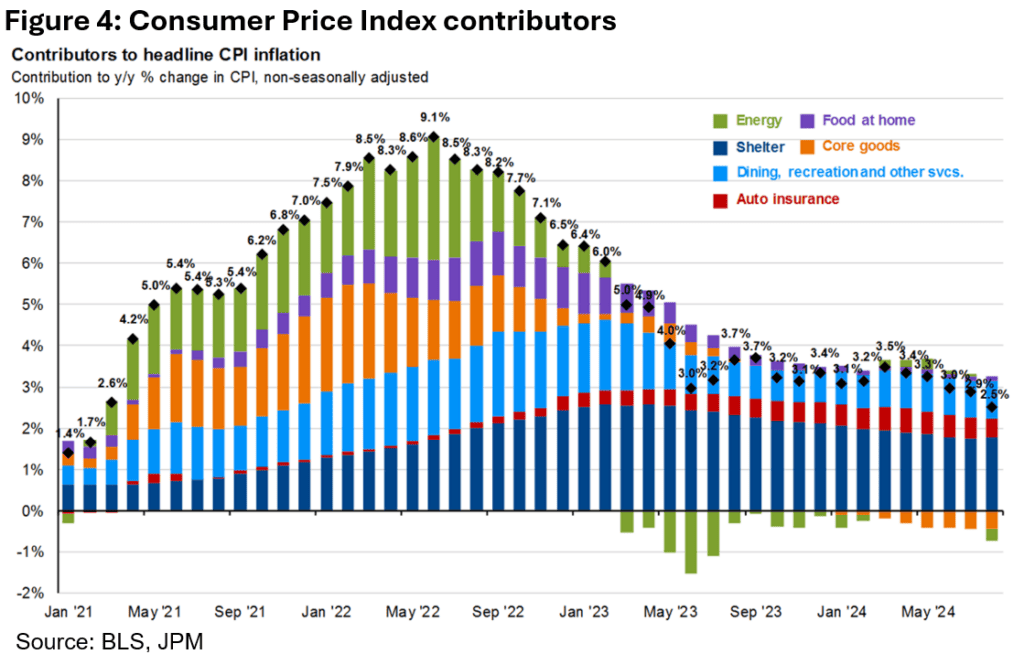

Lastly – but most importantly – we continue to see progress towards curbing inflation. While prices have not come down broadly, the rate of price increases has fallen meaningfully enough that the Federal Reserve has started to cut interest rates. Consumer price inflation is now 2.6%, and core inflation (excluding food and energy prices) is 3.3%. The bulk of remaining inflation is due to shelter (rent costs), auto insurance premiums, and dining prices. If these categories dis-inflate in the coming months, core inflation will fall below 2.0%. (Figure 4, below, shows the components of the CPI – Consumer Price Index.)

Despite the September 0.50% rate cut, monetary policy remains restrictive. As we advance, we expect the Fed to continue cutting rates. As we write this commentary, the market expects a 0.25% cut in November, followed by a 0.50% cut in December. This is positive for markets, especially bonds.

The most significant risk investors face as we enter the fourth quarter is valuation. Stock prices are high, and valuations are extended. Forward multiples are at 21x earnings, about 3x higher than recent averages. Better-than-expected earnings later this month could increase earnings values and contract valuation multiples, but that is not certain.

We don't view the Presidential election's outcome as a significant market event. We are not in the business of speculating in client portfolios on companies that may benefit from a Harris or Trump administration. Additionally, regardless of the top-of-the-ticket outcome, relatively small eventual majorities in both houses of Congress will restrict the scope of any future legislative agenda. Gridlock is more likely, which is generally good for markets.

Geopolitical conflicts could escalate, but U.S. markets are mostly immune to global conflicts. The hot wars in Ukraine and the Middle East have not substantially impacted markets outside of commodities, which we avoid exposure to.

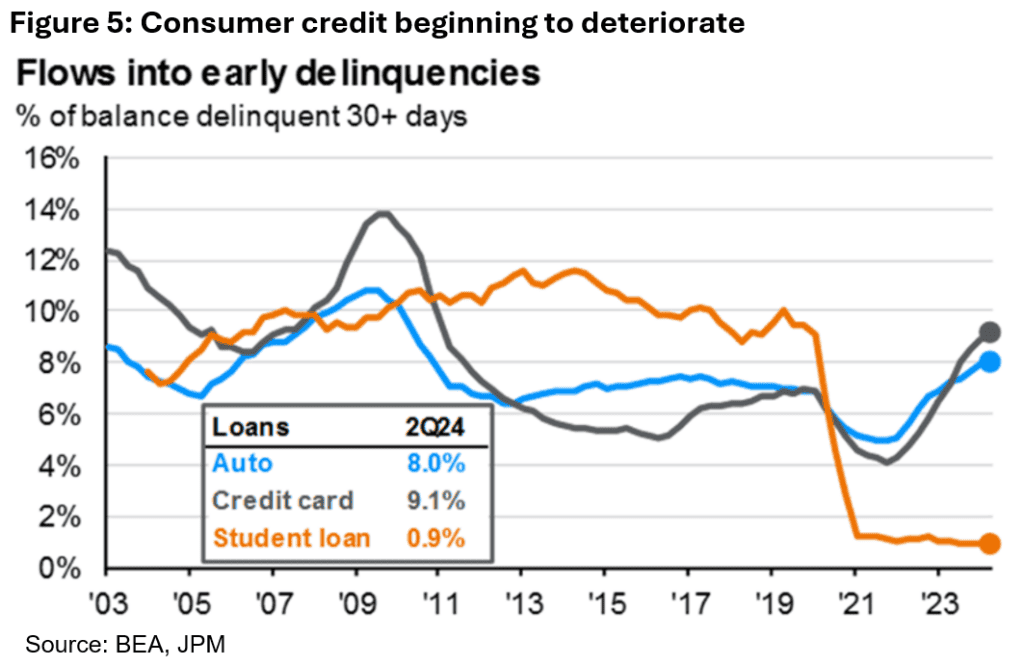

While we aren't too concerned about the consumer at this stage, we keep our eye on debt loads. The average person is now spending about 10% of their disposable personal income on debt service, which aligns with pre-pandemic levels. Credit card balances delinquent for 30+ days are now at around 9%, the highest level in about a decade. (Figure 5, below, shows an uptick in consumer loan delinquencies.)

We expect equity markets to grind higher through year-end, primarily in November and December, assuming no exogenous shock to the system. Should rates continue to fall, we expect a return to mega-cap tech leadership over time, though sector participation may remain relatively broad in the short term. It's still a bit early to lean into small-cap. Should the economic backdrop improve, and after we allow some time for rate cuts to percolate through the economy, the value proposition for smaller companies is enticing. Bonds should do well into year-end, and 2025 prospects are positive for this asset class. The Presidential election will be a distraction in the first half of the quarter, but we don't view either outcome as very impactful for the long-term trajectory of markets.

We like our current asset allocation. The Fed's 0.50% rate cut on September 18th has derisked the market for now. Large-cap U.S. stocks continue to outperform other equity markets over the year-to-date, and bonds should do well as rates come down. Most taxable accounts have minimal tax-loss harvesting opportunities this year, and we expect to essentially hold the course in these accounts. For tax-qualified accounts, we will continue optimizing positions and be more active.

Markets went through a digestion period during the third quarter. We saw two partial corrections – one at the beginning of August and the second at the beginning of September, only to have markets reach new highs by the end of the quarter. For the first time in almost a year and a half, we saw a change in market leadership as mega-cap tech took a back seat to other sectors. The long-awaited rate cut cycle has officially begun, although the speed and magnitude of future cuts remain unclear. We are constructive on markets through the end of the year as the labor market remains stable and inflation appears to be in check. Next year presents new challenges with slowing growth and high valuations. Throughout the fourth quarter, we will adjust our position to reflect the opportunities we see next year.

Thank you for your support and partnership.

Sincerely,

Jim and Mike

jim@leewardfp.com

mike@leewardfp.com