Leeward Investment Team

2024 is beginning with widespread optimism. Equity markets are off to a strong start, having ground higher each of the first three months. Many trends that emerged at the end of 2023 continued through the first quarter. Substantial progress has been made on the inflation front (despite some hiccups), consumer confidence is at its highest level in years and the economy looks solid. Corporate earnings have reflected these healthy trends as companies have delivered on already-high investor expectations in the first quarter. Recession concerns have faded in the current environment, and most economists now expect the U.S. economy to achieve a 'soft landing' (the process of an economy slowing in growth but avoiding a recession) in 2024. Counterintuitively, one of the largest risks overhanging the outlook is that the economy looks "too strong" and that interest rates may need to stay higher for longer to ensure that inflation continues to move lower toward the Fed's stated objective of 2%.

Performance was strong in the first quarter, and many of the leaders from Q4 continued to drive the market higher. The S&P 500 Index returned +10.4%, marking the second consecutive quarter with at least a 10% gain (Q4 2023 +11.7%). Trends in Artificial Intelligence (AI) and infrastructure electrification remained central to the market storyline, as companies exposed to those spaces delivered impeccable earnings. Nvidia (+82.5%) was once again a star performer, bolstered by incredible earnings, and now boasts the third-largest market capitalization in the U.S. at $2.3 trillion. AI companies now account for 15% of the U.S. market.

While many trends remained the same, there were a few thematic shifts in Q1. Small-cap companies, which had outperformed large-caps in Q4 (+14.2% vs. +11.7%), took a step back in Q1 and gained just +5.0% in Q1, whereas large-caps returned +10.4%. After a relief rally in Q4 (+18.2%), the real estate sector fell by -1.3% in Q1, primarily due to increasing interest rates.

The energy sector had a rough fourth quarter, falling -6.6%, but bounced back +13.3% in Q1, leading all sectors. Strength in the energy sector was attributed to oil rebounding from around $70/barrel to $85/barrel as tensions in the Middle East escalated and global demand increased amidst stronger-than-anticipated economic conditions.

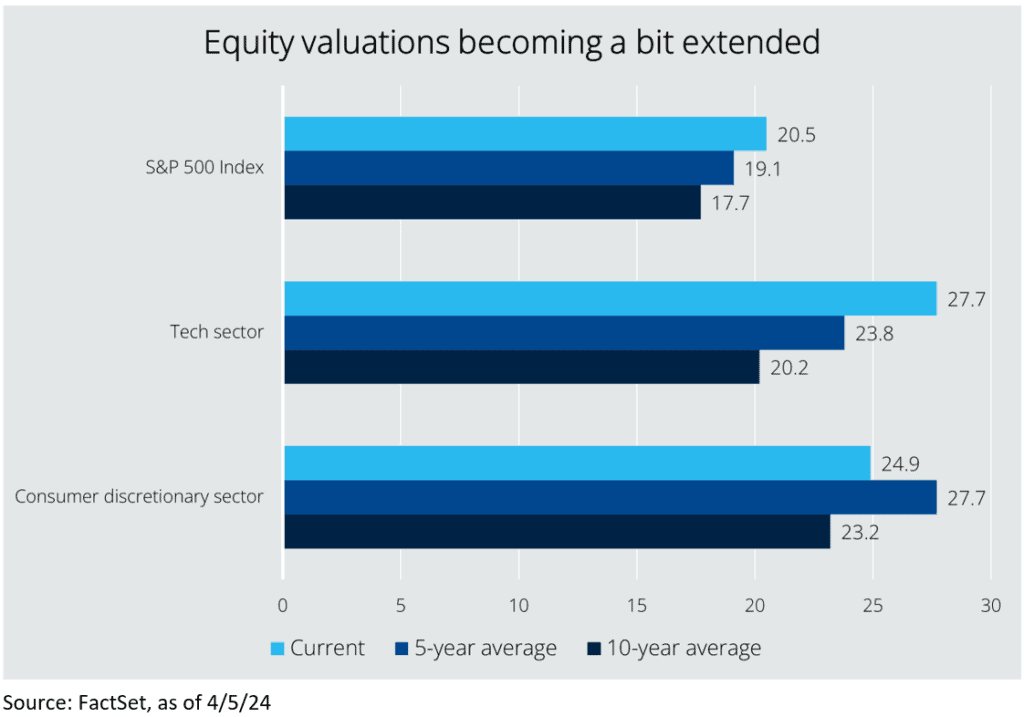

Markets are probably overbought at present, but we believe that the current environment favors momentum, and we want to remain invested in those companies that have participated in the rally. The tech sector started to show some cracks in leadership, with Apple lagging and Google underperforming. Encouragingly, while breadth remains thin, we have begun to see a rotation away from large-cap tech to financials and recently, industrials.

It would be hard to argue that the economy is weakening. The building blocks that sustain household spending—the health of the labor market and household balance sheets—remain rock solid. The final reading of Q4 2023 U.S. GDP showed that the economy grew 3.4%, resulting in full-year GDP growth of 3.1%, an excellent reading. The Atlanta Fed expects Q1 2024 GDP growth to come in at 2.8%.

While the economy appears to be in great shape, interest rates are in uncharted territory. The Treasury yield curve has been inverted (meaning that short-term bond yields are higher than long-term bond yields) for the longest period in history. Yield curve inversions like this have historically been leading indicators of recession. Notably, the economy has shrugged off these higher short-term financing costs and has avoided a recession.

The labor market is strong. Non-farm payrolls have increased by 252,000 per month this year, well above the pre-pandemic average of 200,000. Unemployment has risen from 3.7% in December to 3.9% in February but remains healthy at around 4%.

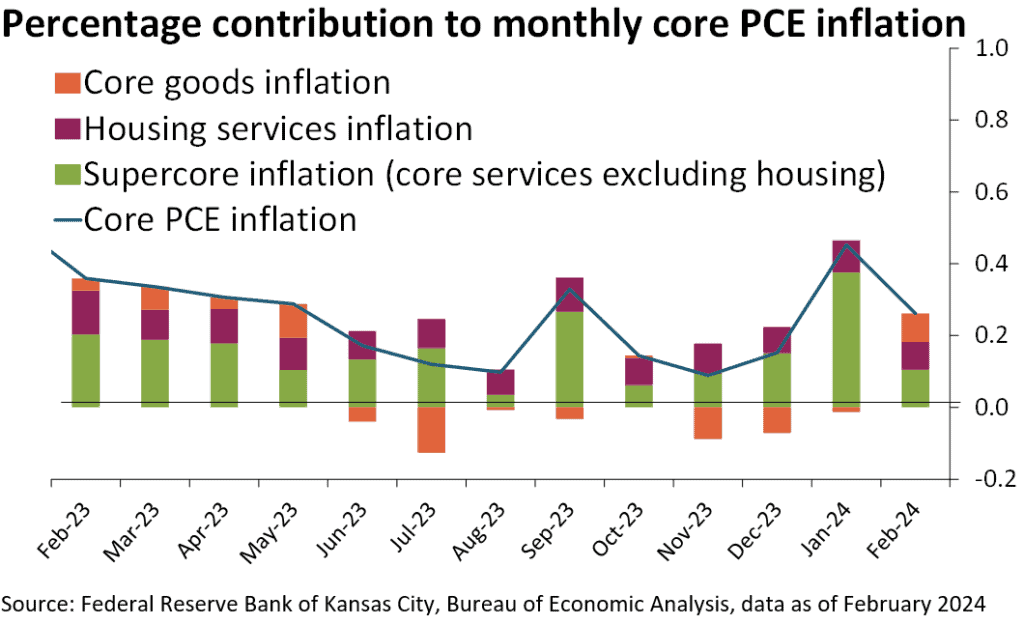

Headline consumer price inflation has stabilized in the low 3% range, with the February reading at 3.2%. However, the February reading also marked the second consecutive month where inflation increased relative to the prior month. While the more robust inflation report was unwelcome news for the Federal Reserve, most of that surprise came from a rebound in energy prices. The Fed's new preferred measure of inflation, "core services inflation," which excludes volatile food and energy prices and shelter, which is a stickier, slower-moving input, rose 0.3% in February after increasing 0.5% in January. This value will be a measure to watch closely in the coming months.

The ISM Manufacturing PMI, which measures activity in the manufacturing economy, rose from 47.8 to 50.3 in March, indicating a return to expansion in the manufacturing sector, driven by rising orders, production, employment, and prices.

Homebuilder sentiment improved, as the National Association of Home Builders' Housing Market Index rose 3 points to 51, bringing it back into the optimistic territory north of 50. Builder confidence rose for a fourth month to its highest level since July due to moderating mortgage rates, strong buyer demand, and low inventory.

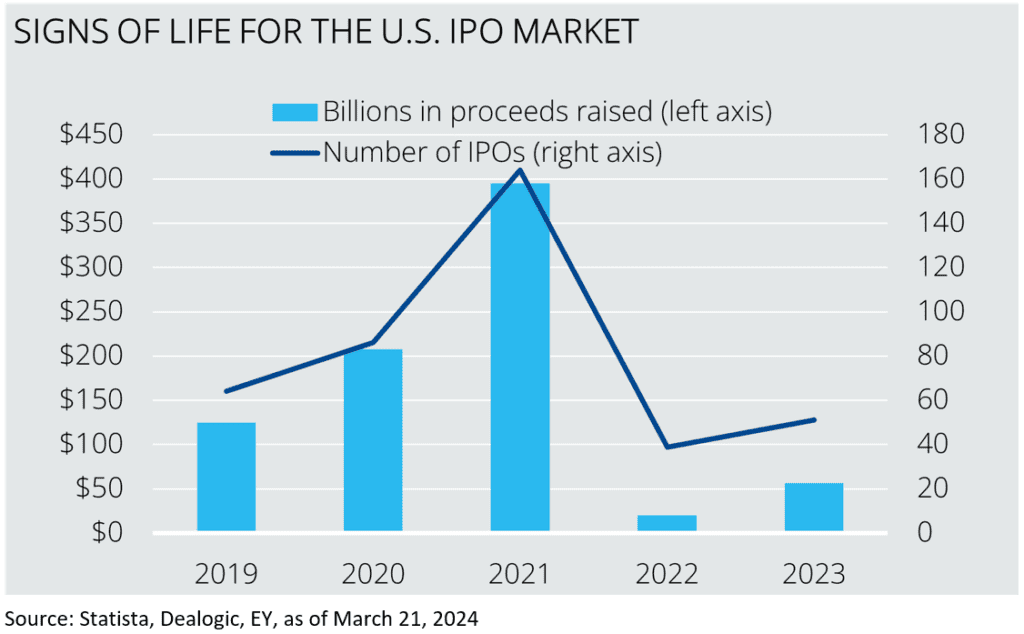

The IPO market is showing signs of life after a very sleepy few years, with Reddit and Astera Labs headlining the list of public offerings this year. With inflation generally moving lower, rate cuts on the horizon, and the stock market near records, the market backdrop for IPOs appears more attractive than at any point since 2021.

As mentioned earlier, inflation is cooling but will likely remain higher for longer. The good news is that the Fed is finally on board with this assessment. At the March Federal Open Market Committee meeting, Fed officials' median expectation for real GDP growth in 2024 picked up from 1.4% to 2.1%, and expectations for core PCE (the Fed’s preferred inflation gauge which excludes food and energy costs) rose from 2.4% to 2.6%. Notably, the "Longer run" federal funds rate projection, which had stood at 2.5% for most of the last five years, nudged up to 2.6%.

The market reaction to the Fed's decision was positive, as the perception was that the Fed would prefer to start reducing rates so long as new economic data confirms a downward trajectory for inflation. If that is the case, then future Fed activity would skew in favor of investors.

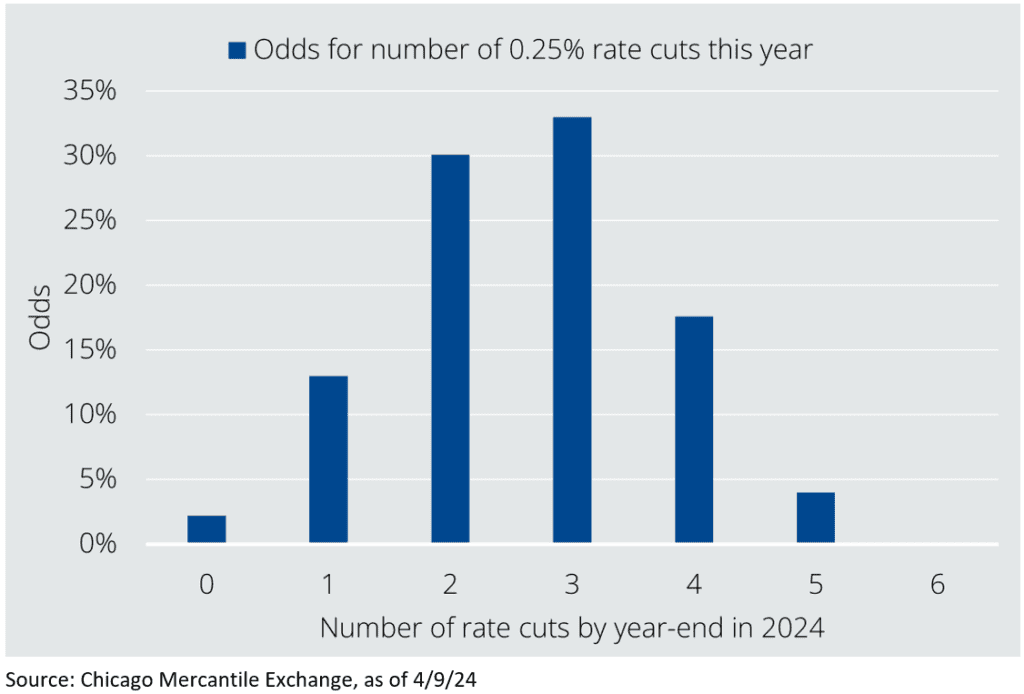

For example, if economic data and inflation heat up slightly, the Fed is not likely to raise interest rates any further. But, if economic activity and inflation slow, the Fed would be ready to move forward with interest rate cuts. As of early April, odds are pretty even that the Fed will begin cutting rates in June and increase in probability throughout the year. Currently, consensus estimates are for 2-4 rate cuts by year-end.

As we enter the spring of 2024, near-term recession risks are unlikely, and the base case is that we achieve a soft landing.

Still, we are cautious, as the market remains too optimistic about rate cuts. The last time the Fed cut interest rates when the economy was not in recession was between July 1995 and January 1996, when Alan Greenspan cut interest rates three times, from 6.00% to 5.25%. These rate cuts signaled the end of the "soft landing" achieved between 1994 and 1995 when the Fed doubled the funds rate from 3% to 6%. In its July 1995 decision, the Fed wrote, "[a]s a result of the monetary tightening initiated in early 1994, inflationary pressures have receded enough to accommodate a modest adjustment in monetary conditions." We will probably hear a similar message from Fed officials early this summer. If the last soft landing in 1995 is a guide, rate cuts will be measured, introducing the risk that the market is priced for deeper rate cuts than the Fed will be willing to make.

Valuations are beginning to flash yellow, but not red. As the market has reached fresh highs, valuations have gotten richer. Still, we do not see any evidence of bubble formation. The critical question will be whether earnings continue to meet strong earnings growth expectations. What we see as extended but not expensive valuations could quickly become rich should earnings disappoint.

We expect the political situation in Washington to remain noisy. Still, as we have stated in prior commentary, neither party's candidate being elected would introduce significant market risks. Over the last 24 general election years, markets have only fallen four times – during the Great Depression, World War 2, the Dotcom Bubble, and the Global Financial Crisis. Market performance during election years is often stellar: the S&P 500 has notched double-digit returns 63% of election years going back to 1928, and we are well on our way to achieving that this year. One bipartisan issue will be the discussion around the debt and deficit, which is starting to approach uncomfortable territory. Unless the fiscal picture begins to improve, we could see interest rates tick up at the expense of current bondholders.

Geopolitical risks remain ever present, especially in the Middle East, where conflicts have the potential to escalate. The Pentagon stated that Israel was behind an airstrike in Syria that killed seven people, including a top Iranian commander. A serious escalation between Israel and Iran could impact stability in the region. In Eastern Europe, President Putin has continued with his strategy of dragging out the conflict in Ukraine so that Western allies' interest in supporting the war continues to wane. In China, domestic growth issues and concerns over the housing sector have kept the CCP leadership focused internally. Taiwan-related tensions have faded for now.

We closed out 2023 with modest profit-taking and tax-loss harvesting when available. During the first quarter, we largely held onto existing positions and recycled lagging investments with interest rate-sensitive holdings. We were most active in portfolios with small capitalization investments. This asset class has been less consistent since the start of the year, requiring more movement to capitalize on new opportunities. We anticipate adjusting our healthcare and financial services holdings during the second quarter as we seek better risk-reward opportunities in these sectors. We are also actively reviewing consumer discretionary holdings at this time.

For fixed income, we have largely maintained our existing positioning. At the end of last year, we modestly increased the length of our bond holdings (called 'duration'). There may be an opportunity to increase further, but for now, we are satisfied with our current bond positioning.

International markets are beginning to pick up. Japan is becoming attractive for the first time in decades, growth is accelerating in India, and select European markets appear to be attractively valued. To the extent we invest in these geographies, we'll focus on exchange-traded funds (ETF) investments rather than individual stocks.

We expect markets to consolidate in the near term as investors absorb two sequential quarters of significant appreciation. We view this phenomenon as healthy. Over the next twelve months, though, markets are well supported. Inflation should trend lower, interest rates fall, and earnings should remain robust. As long as the geopolitical temperature stays the same and there are no exogenous shocks to the system, we expect positive investment returns in client portfolios. Should one of those conditions develop in another direction, we will reassess our attitude toward risk assets and adjust portfolios accordingly. But for now, we're confident that 2024 will be an above-average year for investors.

Thank you for your business and partnership.

Best,

Jim and Mike

jim@leewardfp.com

mike@leewardfp.com